More Non-SNP PPO plans introduced than HMO for the first time in 2022

October 27, 2021 4 min read Report

October 27, 2021

4 min read

Report

More non-SNP PPO plans introduced

than HMO for the first time in 2022.

While the total number of new plans introduced in 2022 is lesser than that of 2021, the combination of aggressive expansion by a national payors, significant shifts in cost factors (ex. maximum drug deductible), and a major focus on PPO offerings may create volatility in the market.

Major Findings

- More Local PPO plans introduced than HMO plans

- Maximum Annual Drug Deductible increased by 9% to $480

- Growth of total MAPD plans declines for the second year in a row

- 31 counties across 6 states will see zero premium plans introduced for the first time

- Over the Counter (OTC) continues to be the fastest growing benefit, now present in 80% of non-SNP plans

- Eyewear, dental preventive, physical exams, and hearing aids are now present in over 90% of non-SNP plans

As of October 2021, enrollment in Medicare Advantage (MA) has exceeded 27.5 million, a 9.9% increase over the 25 million enrolled in a Part-C plan last year. To meet the growing demand, the number of non-SNP MA plans will increase by 9%, or 452 plans, as per the data set released by the Centers for Medicare and Medicaid Services (CMS) and analyzed in our 2022 AEP Findings Report which can be accessed here.

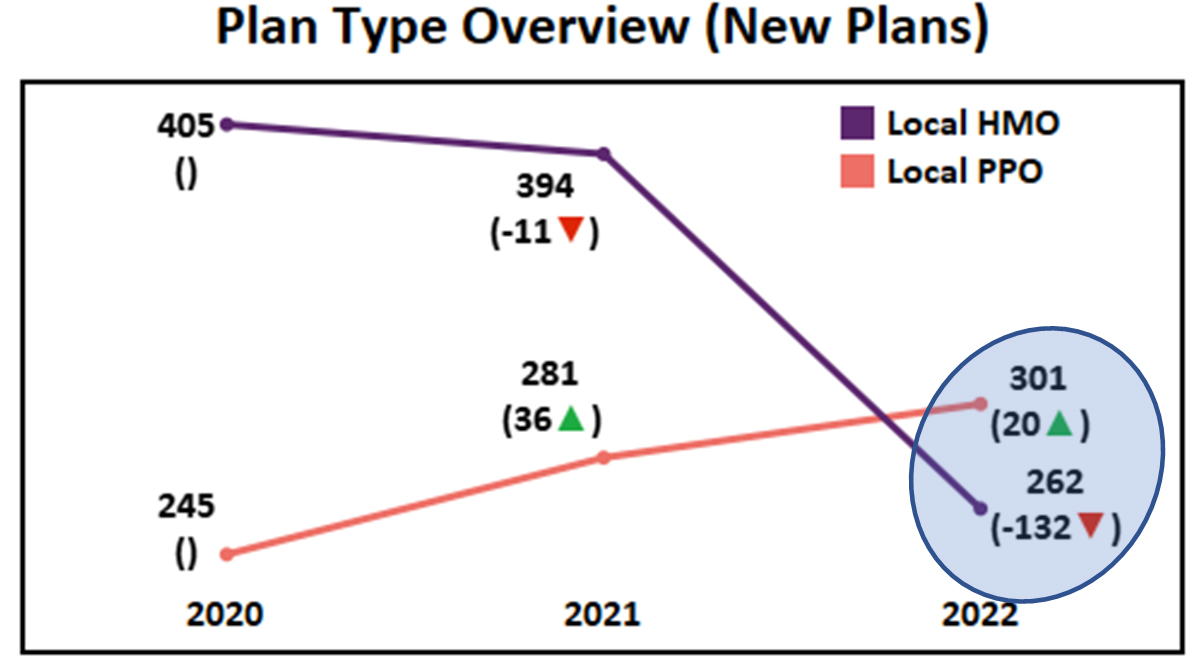

With the ever-growing prominence of PPO, and in line with our prediction that PPO enrollment will eclipse HMO enrollment by 2030, 2022 will mark the first time where more Local PPO plans are introduced nationally than HMO in the non-SNP plan segment. A rapid market shift and an indication that Payors are closely following the trend of consumer preference, in which PPO enrollments have increased dramatically over the past few years. (To read the full 2021 Post-AEP Findings Report click here.)

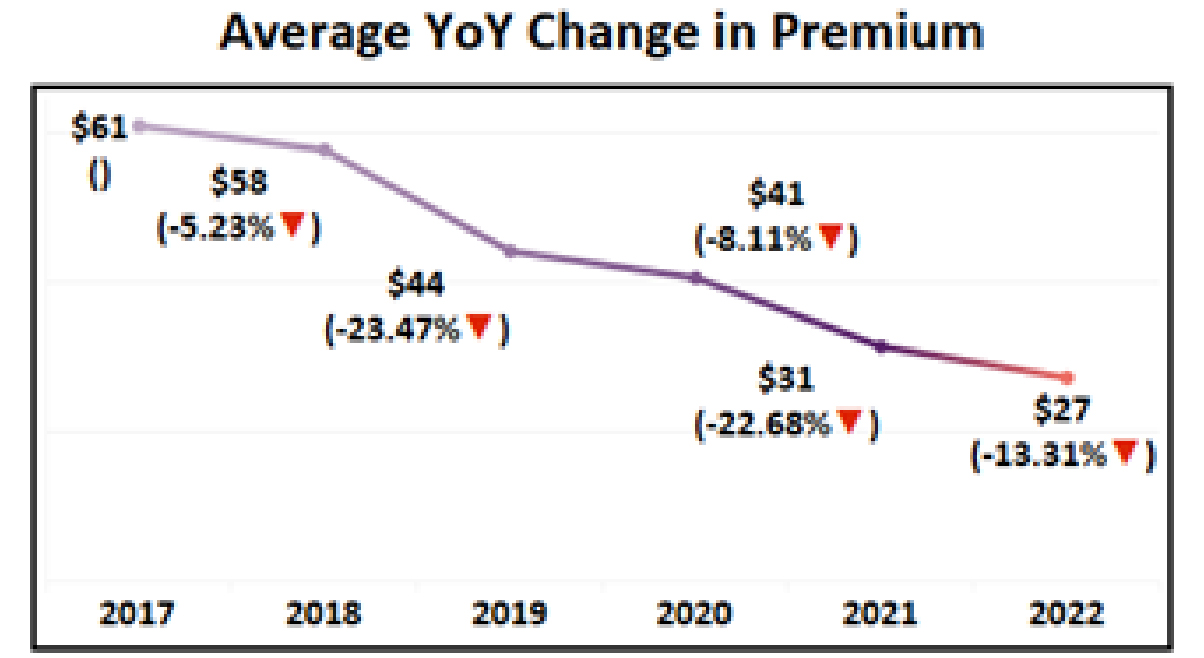

A breakdown of HMO and PPO plan types further showcases the importance of low premiums, specifically zero-dollar plans, which was the only non-SNP premium segment of HMO that saw an increase in the total number of plans. While the PPO market has also shown a clear preference toward lower premiums in recent years, unlike HMO there appears to be more flexibility and less premium sensitivity with all segments below $50, each seeing growth in the total number of plans.

Though zero-dollar premium plans are dominating the national market, there exists today a small number of markets across the country (73 counties) which lack zero-premium non-SNP options for consumers. In 2022, 31 of those counties, spread across 6 states, will see the introduction of at least one zero-premium, providing a new option for over 126,000 Medicare eligibles. In contrast, the remaining 42 counties which will continue to lack zero-premium plan options, represent an opportunity market of over 500,000 Medicare eligibles.

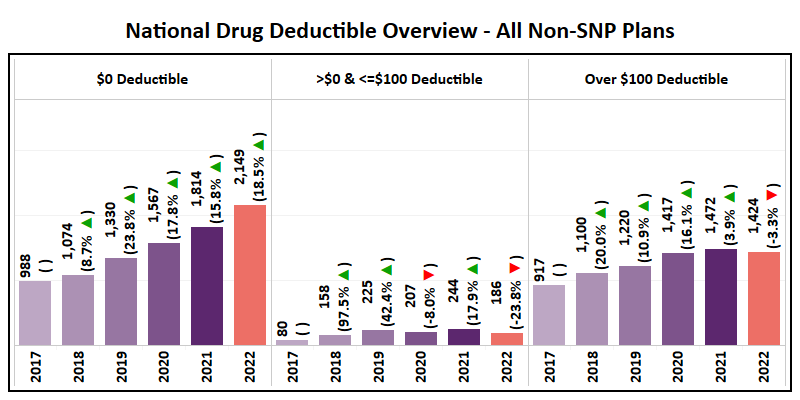

Aside from premium trends, many other plan variables are also seeing year-over-year variations. Maximum drug deductible for MA Non-SNP plans, as an example, has increased by 8% in 2022 to $480 while the national average has remained fairly constant, having only a slight decrease of 1%. Even with this increase in the max drug deductible, the zero-dollar segment is the only segment to see an overall growth this year. However, the greater than $100 segment continues maintains its position as the second-largest segment, dividing the market between two extremes.

While being on top of cost factor trends and plan type trends allows payors to maintain a competitive edge, it is equally important to keep track of benefit trends. Some benefits, such as eye exams and supplemental emergency have been present in over 90% of non-SNP plans since 2017, other benefits are reaching the same saturation point. Eyewear (2017: 70.6%), dental preventive (2017: 74.3%), physical exams (2017: 77.7%), and hearing aids (2017: 59.3%) are now present in over 90% of non-SNP plans, with multiple other benefits approach this benchmark. OTC the fastest growing benefits in recent years, will be present in over 80% of non-SNP plans next year, compared to only 32% inclusion in 2017.

Lastly, with long-term growth being at the forefront of almost every organizational strategy, two Payors, Centene Corporation and Molina Healthcare, are seen as the most aggressive in 2022. Centene Corporation, having added 122 new plans nationwide, has expanded into 5 new states with 361 total new counties added to their service area, representing a 29% expansion YoY. Molina on the other hand has added 22 new plans and expanded into 4 new states with 287 new counties added to their service area, representing an 85% expansion.

The entire 2022 AEP Findings Report is available at

https://www.healthworksai.com/2022-aep-findings-report/

To revisit the 2021 Post-AEP Findings Report, detailing major market shifts from the past AEP, visit https://www.healthworksai.com/2022-aep-findings-report/