2022

Post AEP

Findings Report

February 28, 2022 Report

National Overview

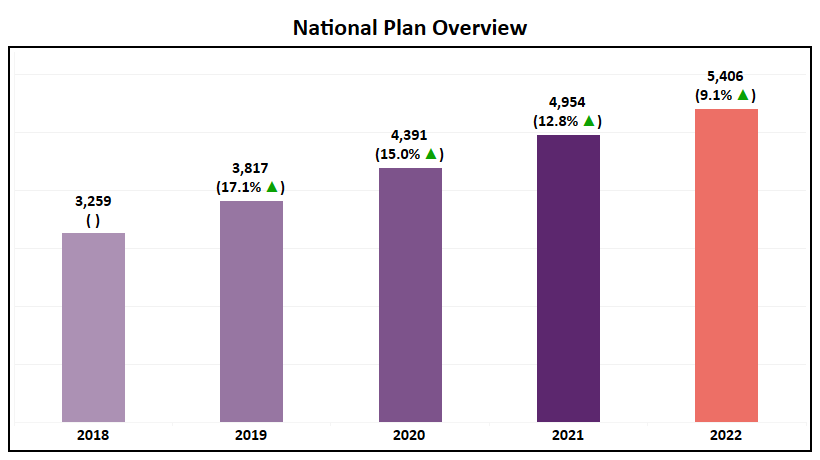

1.1 Plan Overview

-

At an overall level, the number of plans available in the MA market will grow 9% YoY, taking the total number of plans to 5,406 in 2022.

-

For the first time since 2018 the new growth of plans has dropped below 550.

-

With an 8.6% decrease in new plans for 2022 (822 new plans in 2022; 899 new plans in 2021), only 15% of plans were new plans and initial plans with the rest comprising of renewal plans.

-

The decrease in the introduction of new plans may indicate that the market is stabilizing, and existing plans have caught up to new plans in terms of value to beneficiary.

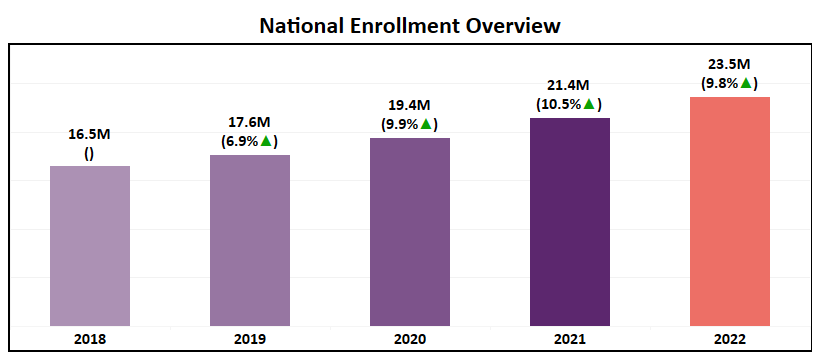

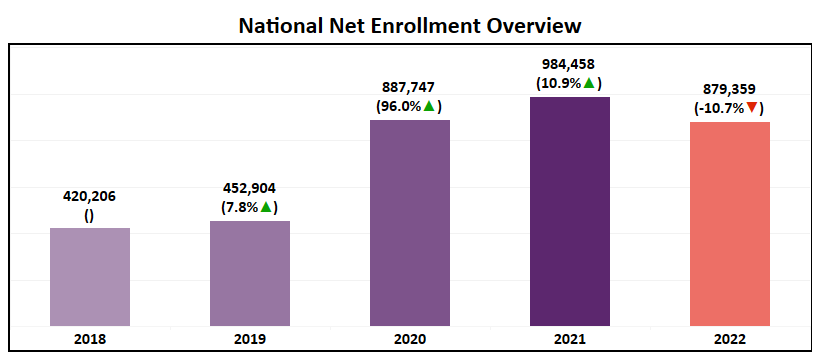

1.2 Enrollment Overview

-

YoY enrollment has grown at a steady rate with an 9.8% increase in 2022.

-

2020 saw the biggest jump in net enrollment (Jan’2020 – Dec’2019).

-

2022 witnessed a drop of 10.7% in net enrollments for the first time since 2018.

-

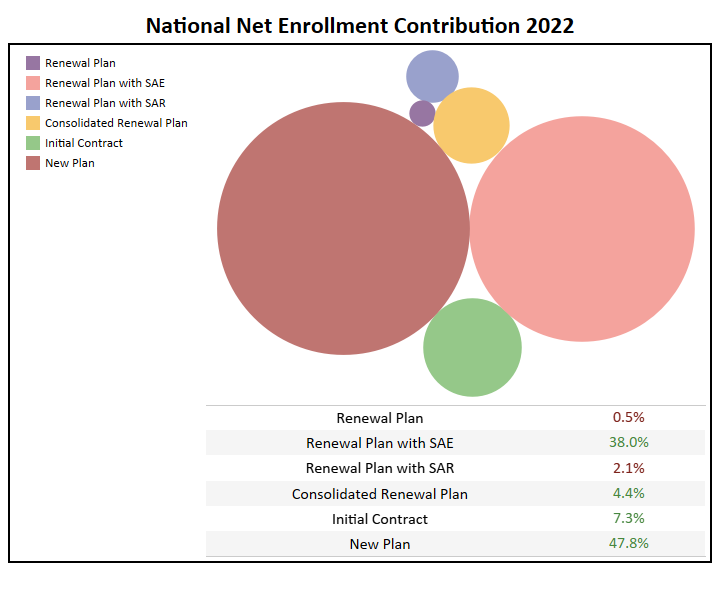

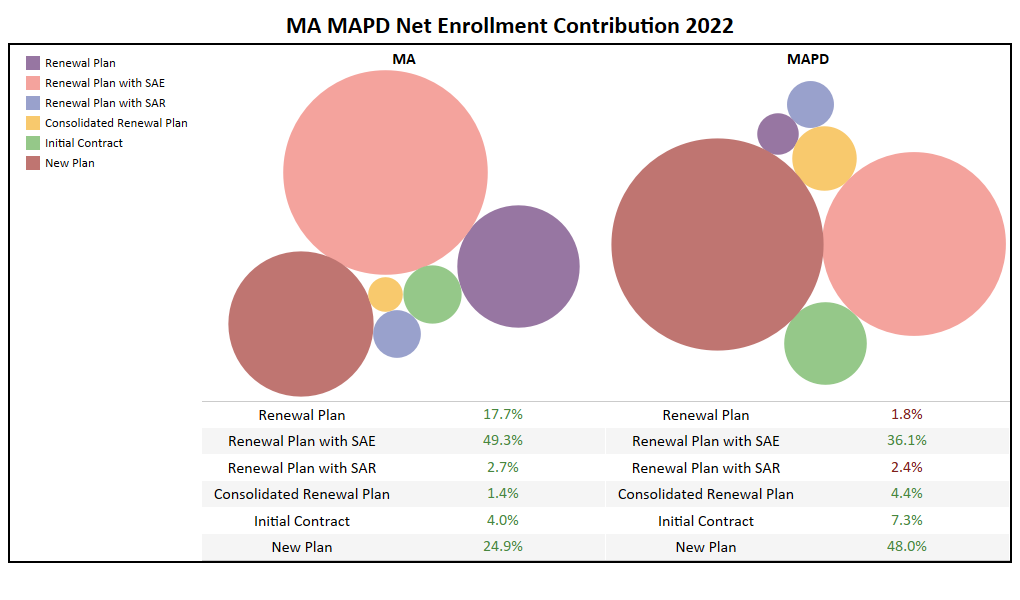

Looking at the contribution of net enrollments, most enrollments come from new and initial plans.

-

Renewal plans and renewal plans with service area reduction (SAR) were the only plans that saw a net loss.

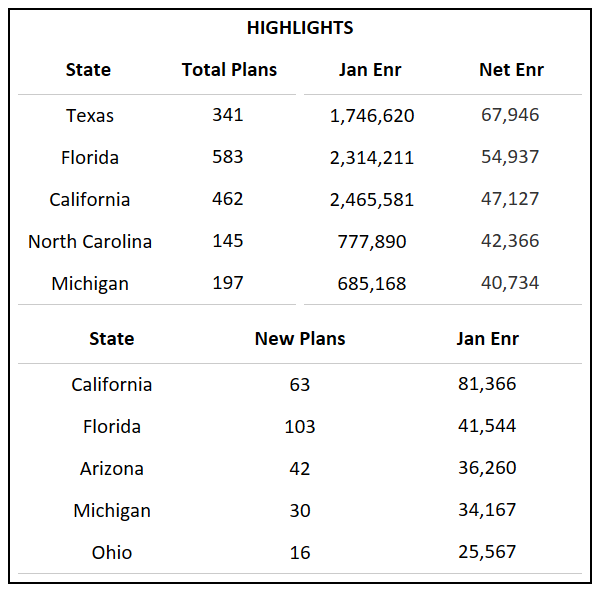

1.3 National Highlights

-

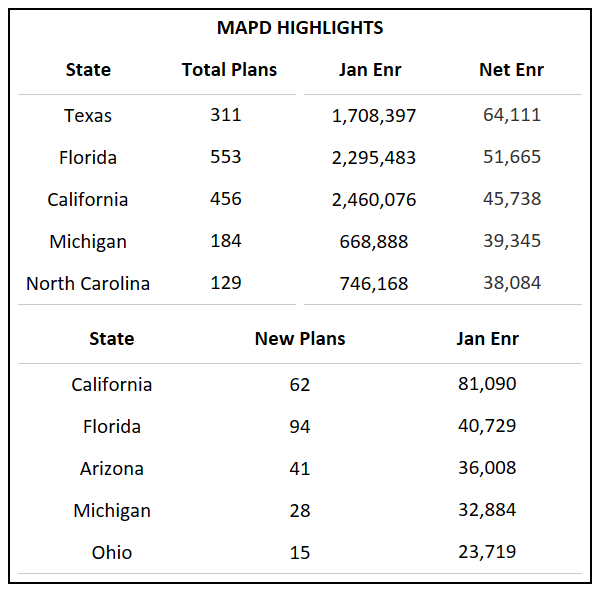

Texas, Florida, and California continue to be top markets in terms of total enrollment.

-

For new plans, Arizona, Michigan, and Ohio are states that stand out in terms of enrollment.

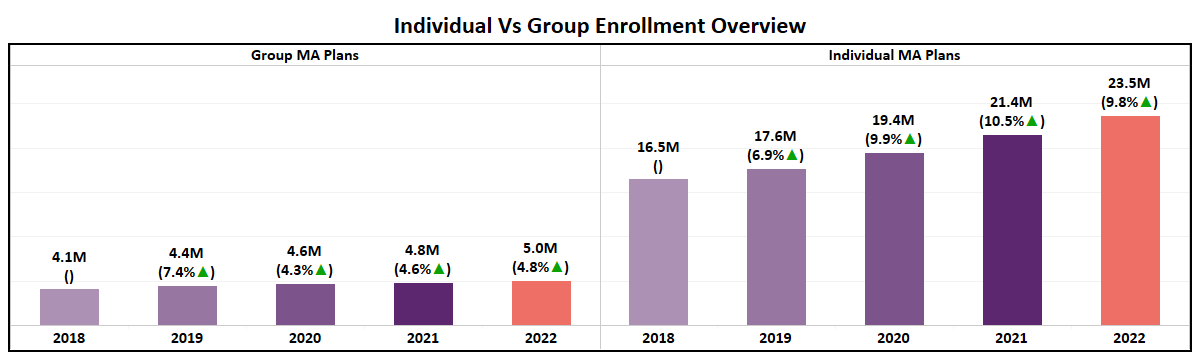

Individual Plans vs Group Plans Overview

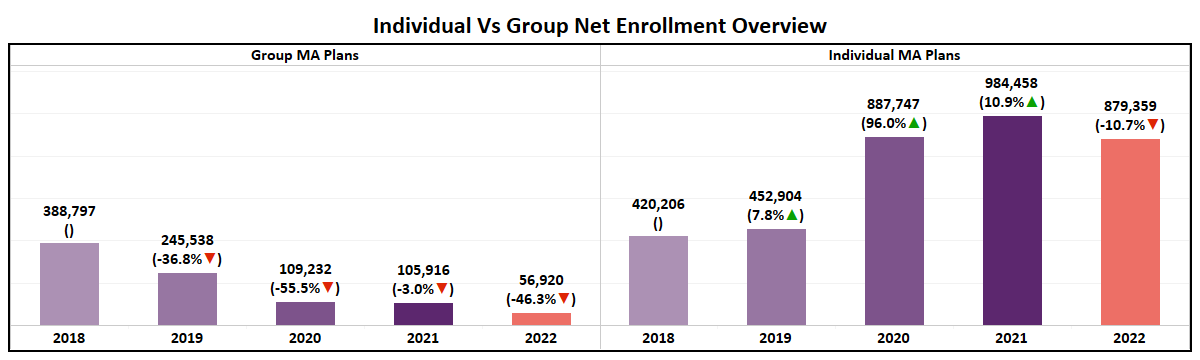

2.1 Enrollment Overview

-

For a 5th year in a row, group plans remain stagnant in terms of overall enrollment.

-

The YoY net enrollment has declined as well.

MA vs MAPD Overview

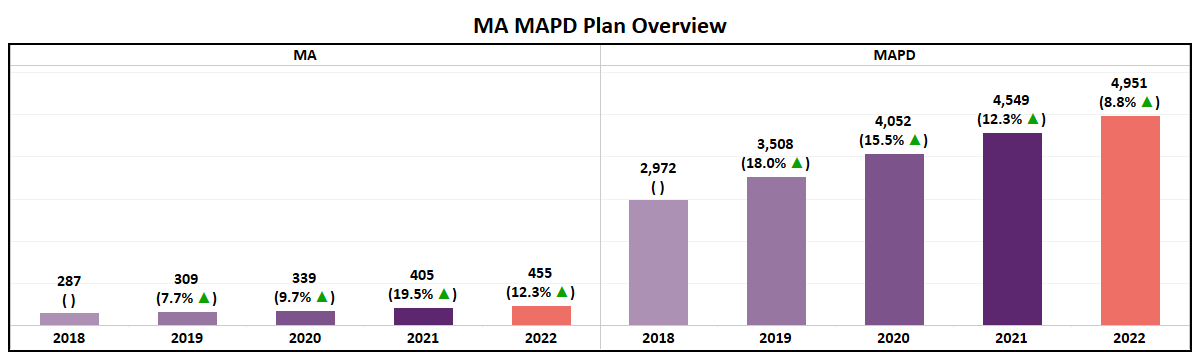

3.1 Plan Overview

-

Most of the growth in the Medicare Advantage ecosystem comes from MAPD plans which saw a net growth of 402 plans compared to 50 for MA only.

-

For the second year in a row the absolute number MAPD plan growth has fallen (2020 grew by 544 plans; 2021 grew by 497 plans; 2022 grew by 402 plans), indicating that the market may reach saturation at the highest level.

-

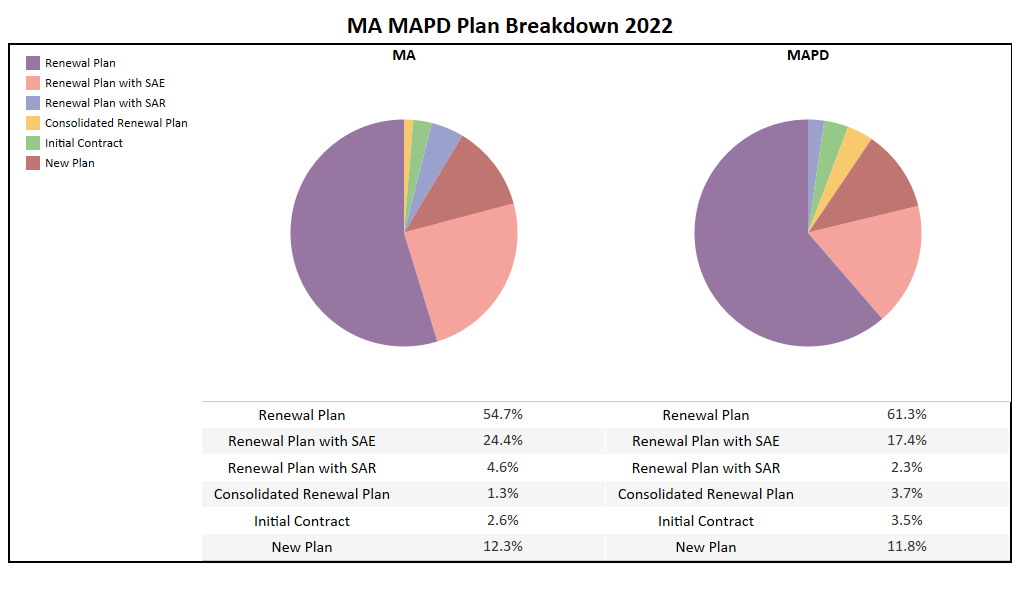

~15% of both MA and MAPD plans comprise of new and initial plans while the rest are renewal plans.

-

A higher percentage of MA plans expanded into new service areas.

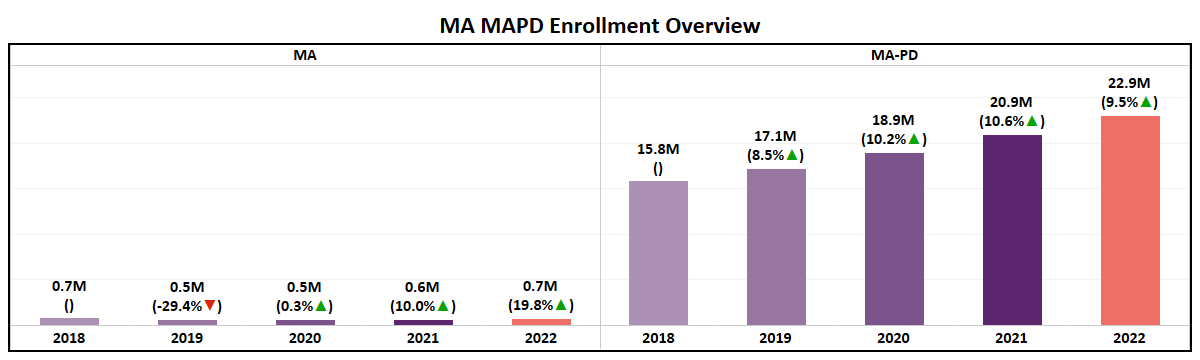

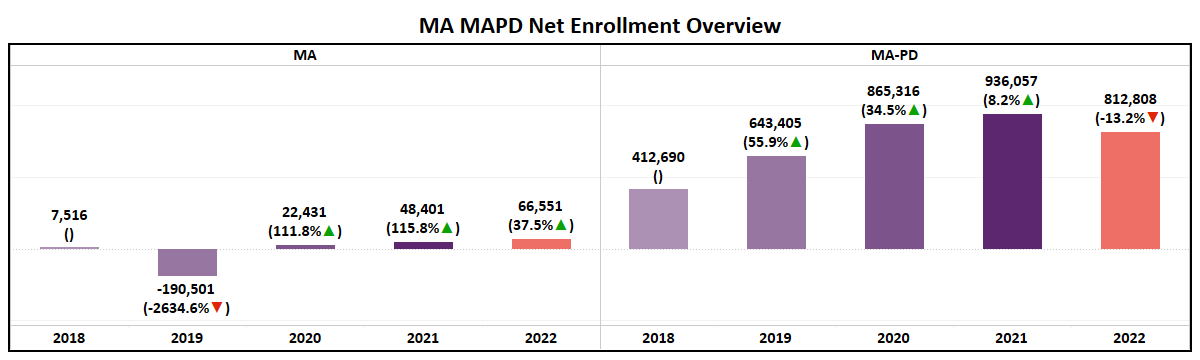

3.2 Enrollment Overview

-

While MA plans saw a 19.8% growth, compared to MAPD plans the trend is near stagnant for the past 5 years.

-

MAPD plans have been growing by nearly 2 million each year since 2021.

-

Even with a 13.1% fall in net enrollments from last year, MAPD plans captured most of the net enrollments in 2022.

-

MA plans saw enrollments gains across the board while MAPD plans witnessed net enrollment loss in renewal plans, and renewal plans with service area reduction.

-

Nearly half the net enrollments for MA plans came from renewals plans with service area expansion and over half the net enrollments for MAPD plans came from new and initial contracts.

3.3 MA Vs MAPD Highlights

-

Texas and Florida are the only two states that are in the top 5 for both MA and MAPD plans in terms of net enrollment.

SNP Type Overview

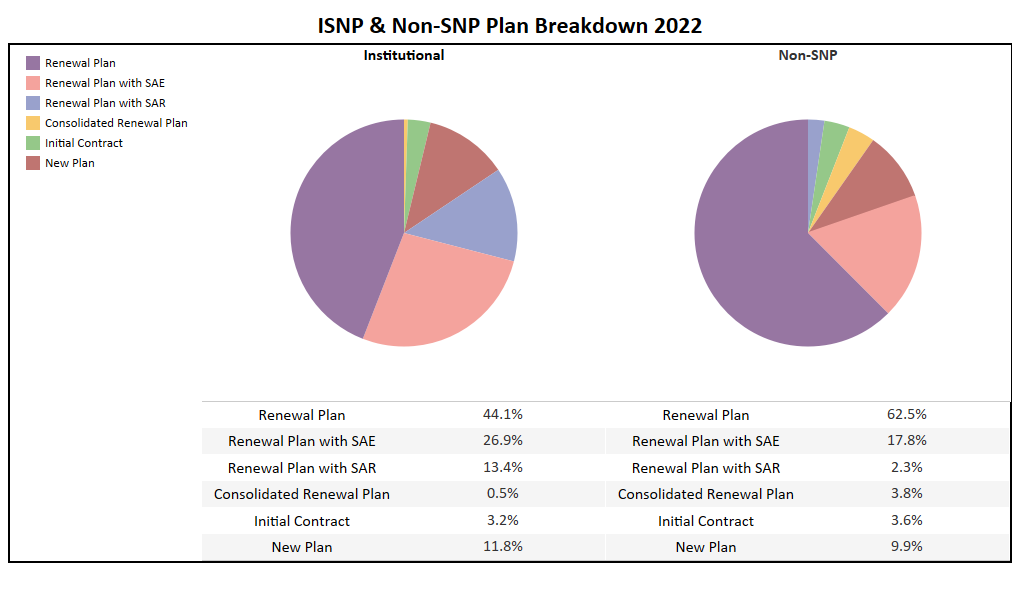

4.1 Plan Overview

-

All SNP categories will have a net plan increase for the third year in a row.

-

A YoY net growth of 7% for non-SNP plans is the lowest in the past five years, over which the category has typically had an annual increase of 11-18%.

-

CSNP has 29% of plans as new plans or initial contracts, the highest among all SNP Types.

-

CSNP and DSNP each saw an increase in the number of new plans introduced while ISNP and Non-SNP both saw a decline, each decreasing by ~17%.

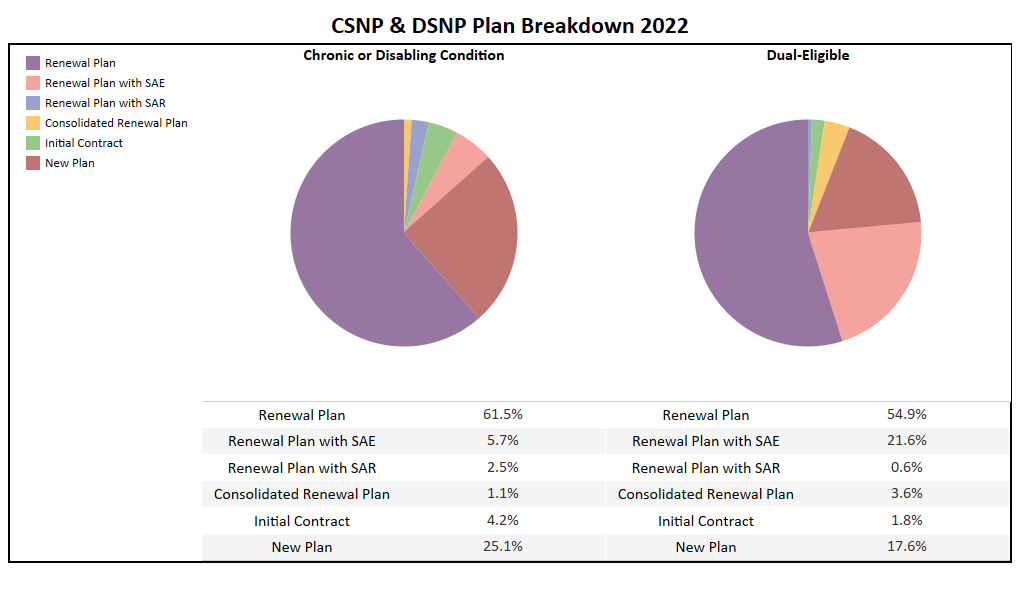

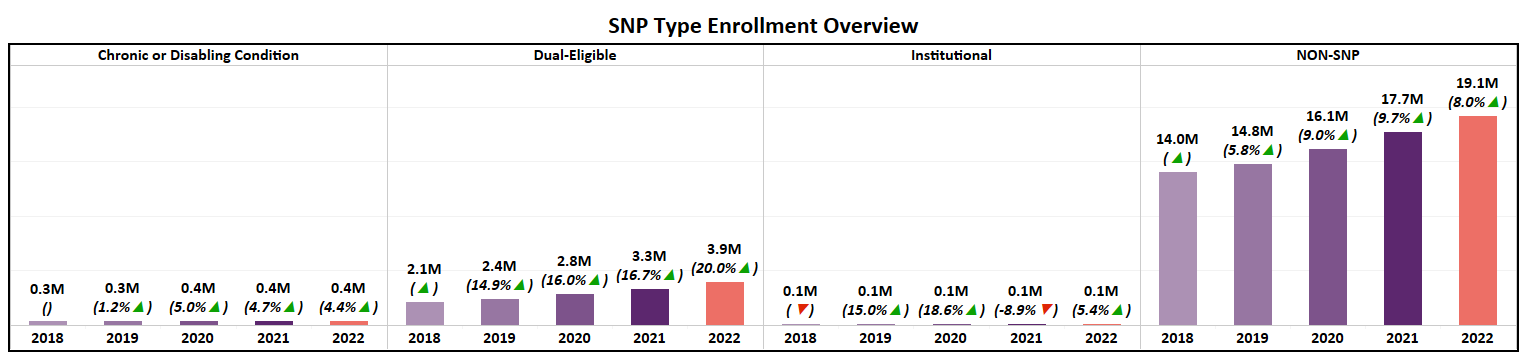

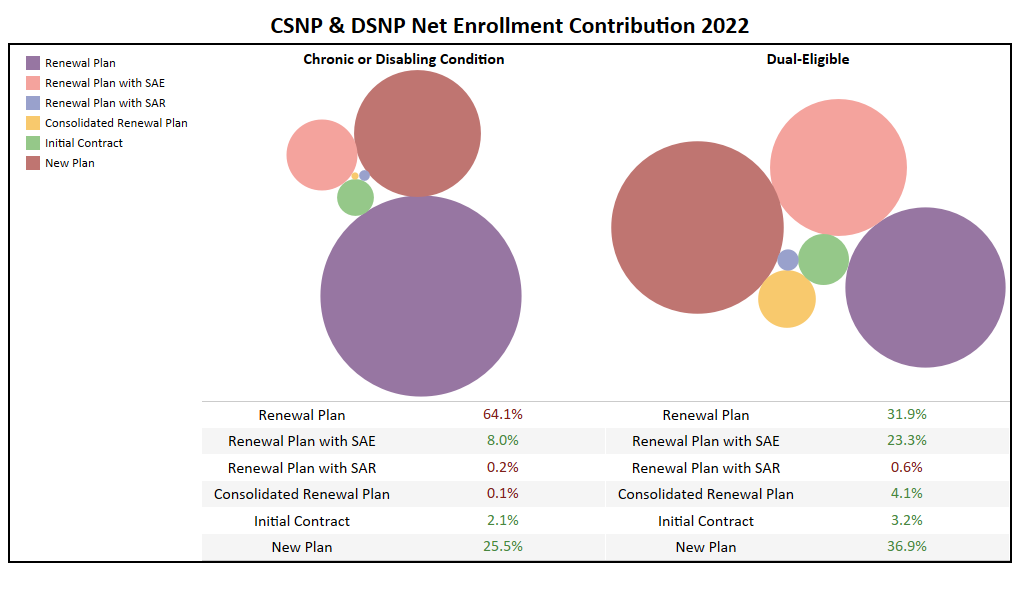

4.2 Enrollment Overview

-

While all SNP Types saw an increase in enrollment in 2022, CSNP and ISNP continue to remain stagnant with minimum growth.

-

DSNP and non-SNP are the only two that saw steady growth with DSNP growing by 20%, the highest in the last 5 years.

-

DSNP is the only SNP Type that saw a growth in net enrollment captured while non-SNP saw a decline of 14%.

-

CSNP for a second year in a row has seen net loss in enrollment.

-

While CSNP performed well in new plans, the overall loss in enrollments was due to renewal plans.

-

DSNP plans perform equally well with new plans and renewal plans.

-

ISNP grew by just 810 net enrollments, most of which came from service area expansions and initial contracts.

-

Like ISNP, non-SNP too saw most of their net growth come from new plans and service area expansions.

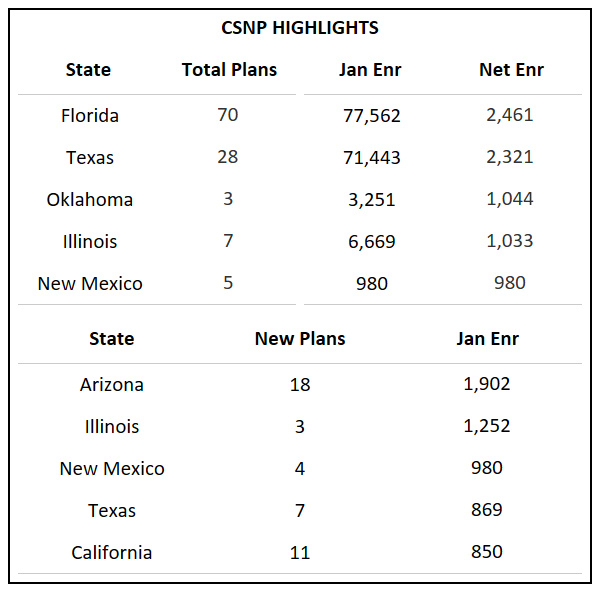

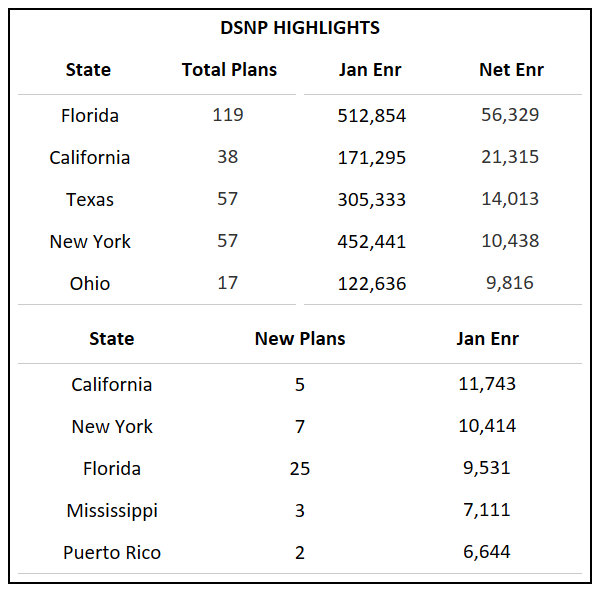

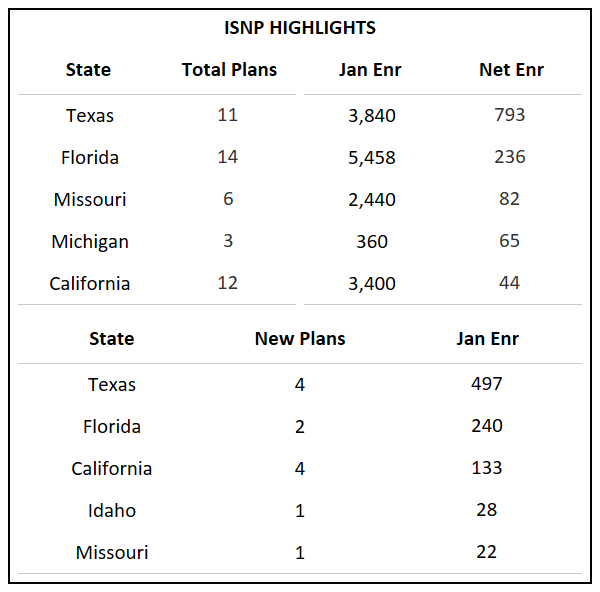

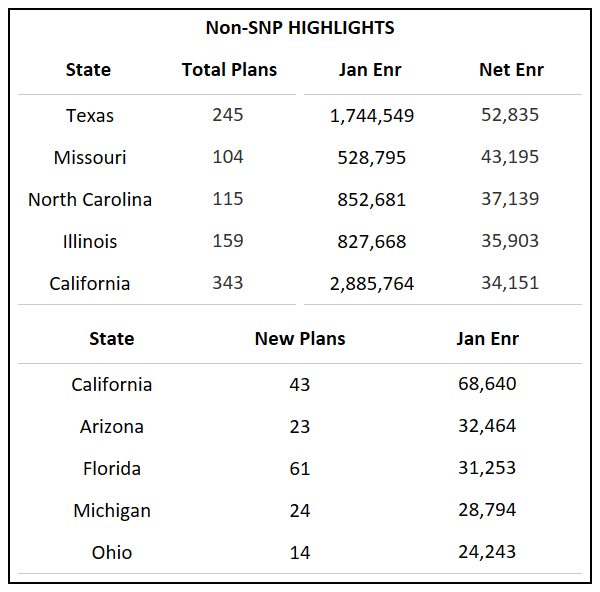

4.3 SNP Type Highlights

-

Texas remains one of the top states for all SNP Types.

-

Arizona gained the second highest enrollments for new plans, beating even Florida.

Plan Type Overview

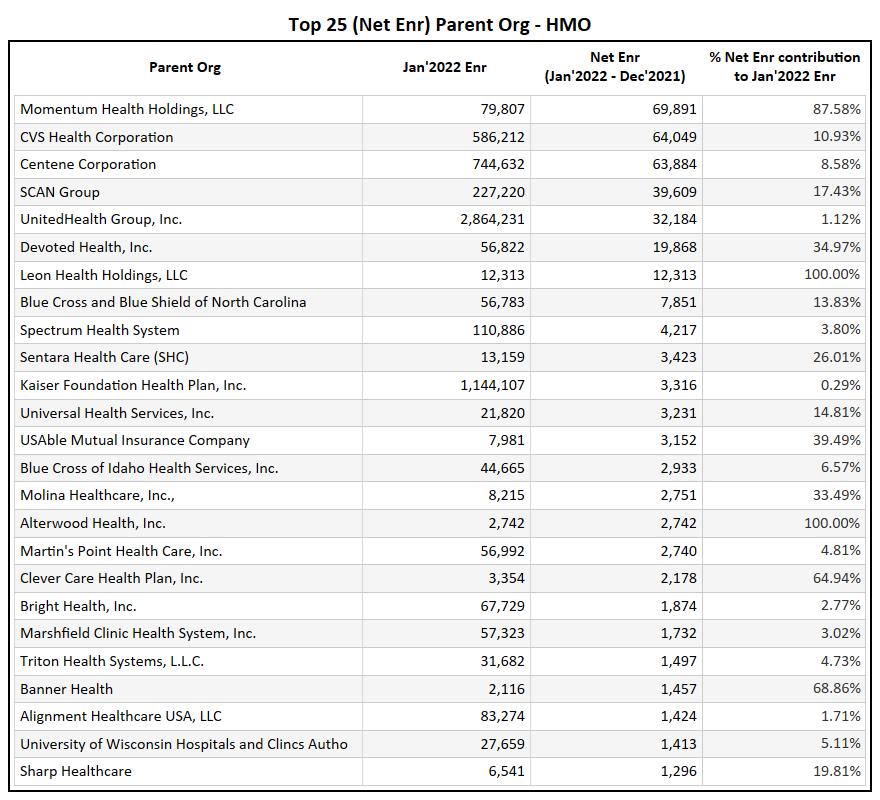

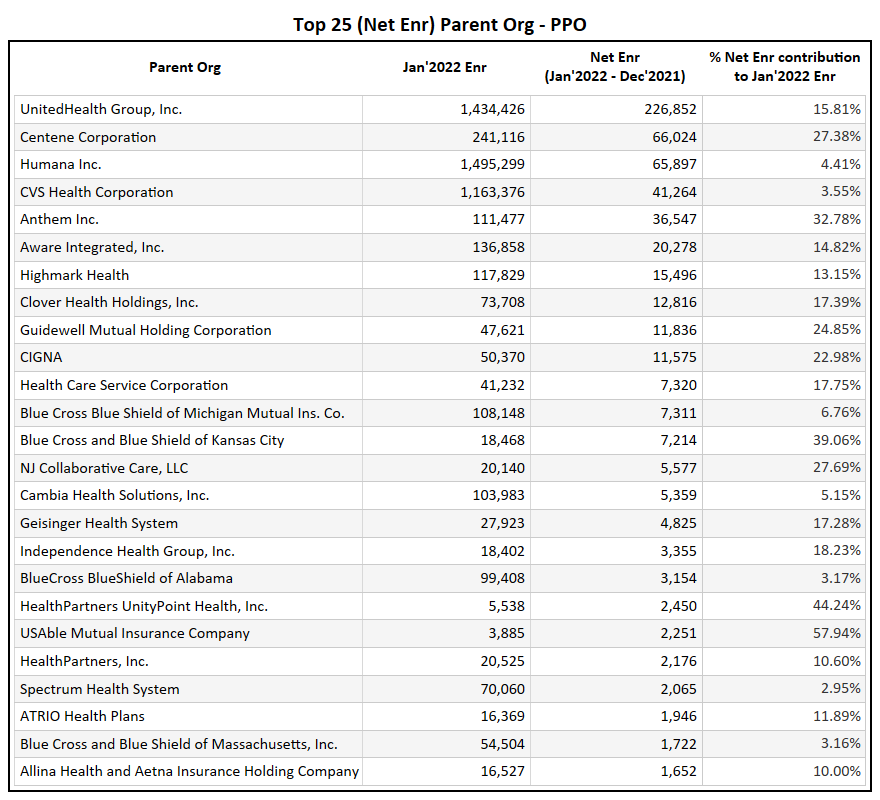

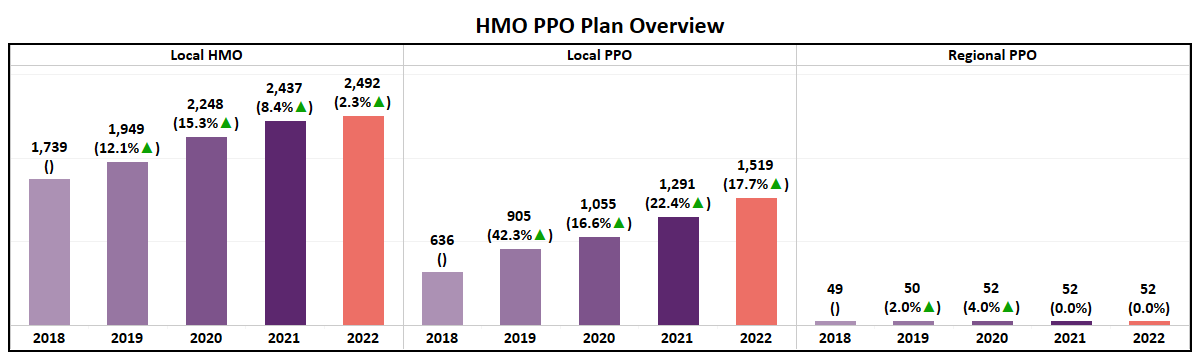

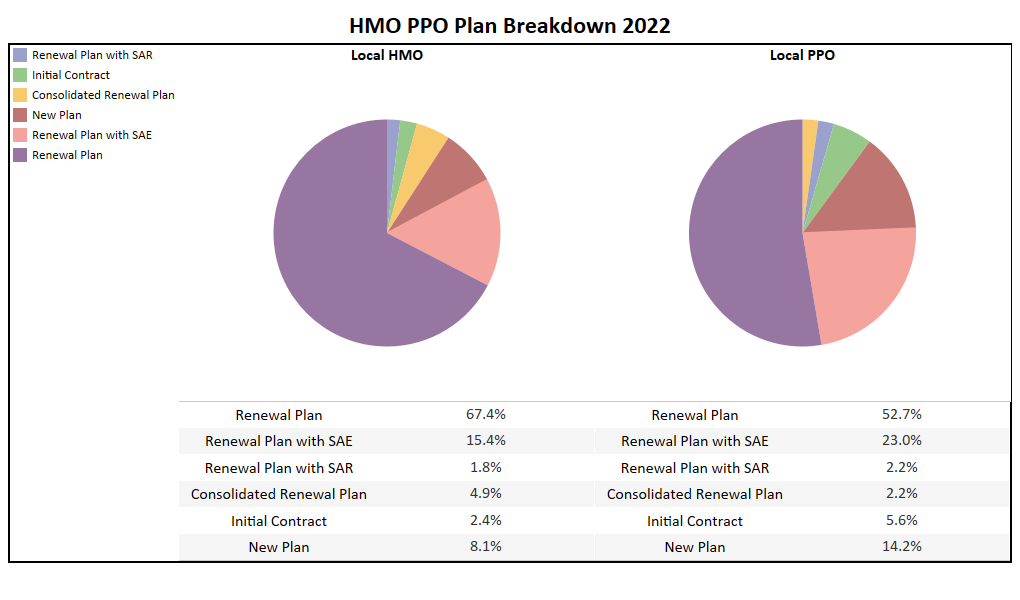

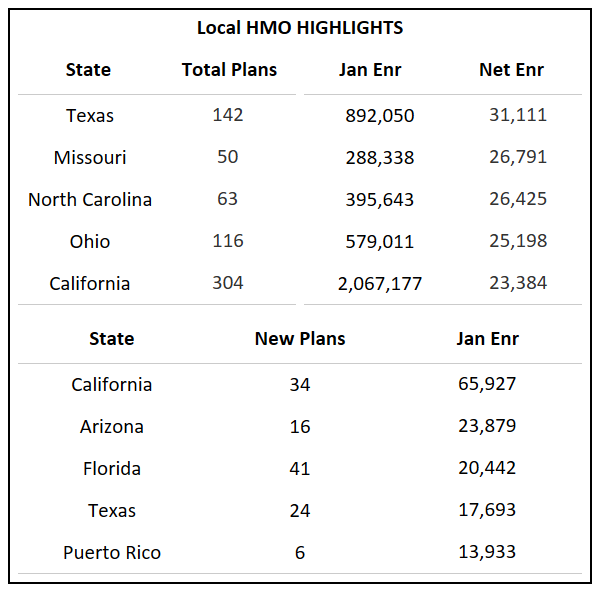

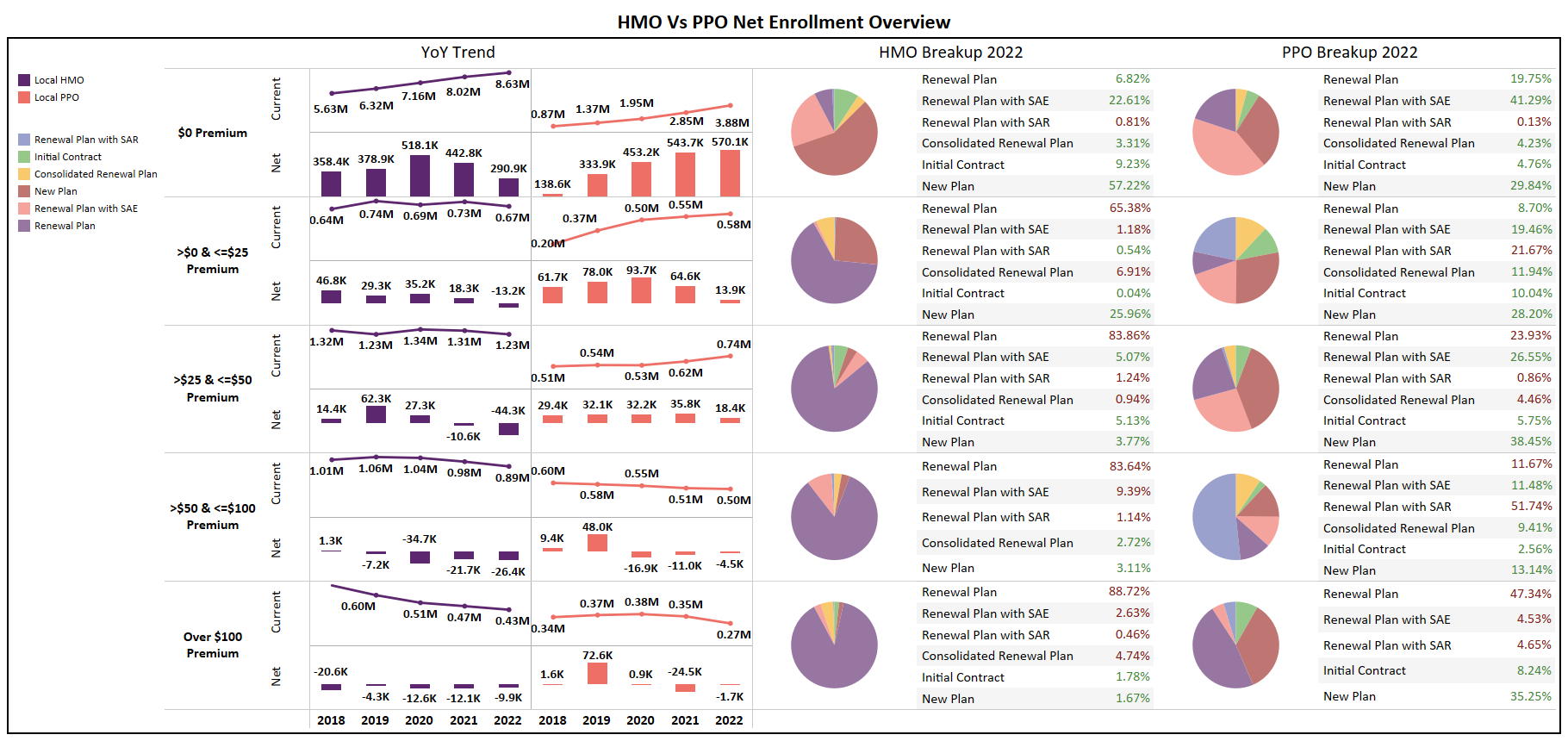

5.1 HMO PPO Plan Overview

-

Both HMO and Local PPO grew in net plans, and while Local PPO has grown according to the trend, HMO may be entering a plateau.

-

2022 marks the first time since this analysis began (2017) that the market will see more Local PPO plans introduced nationally than HMO. A major market shift and an indication that Payors are following the trend of consumer preference in which PPO enrollments have increased dramatically over the past few years.

-

~ 20% of PPO plans were new plans in 2022 compared to ~ 10% for HMO plans.

-

A higher percentage of PPO plans (23%) have had service area expansion compared to HMO plans (15%).

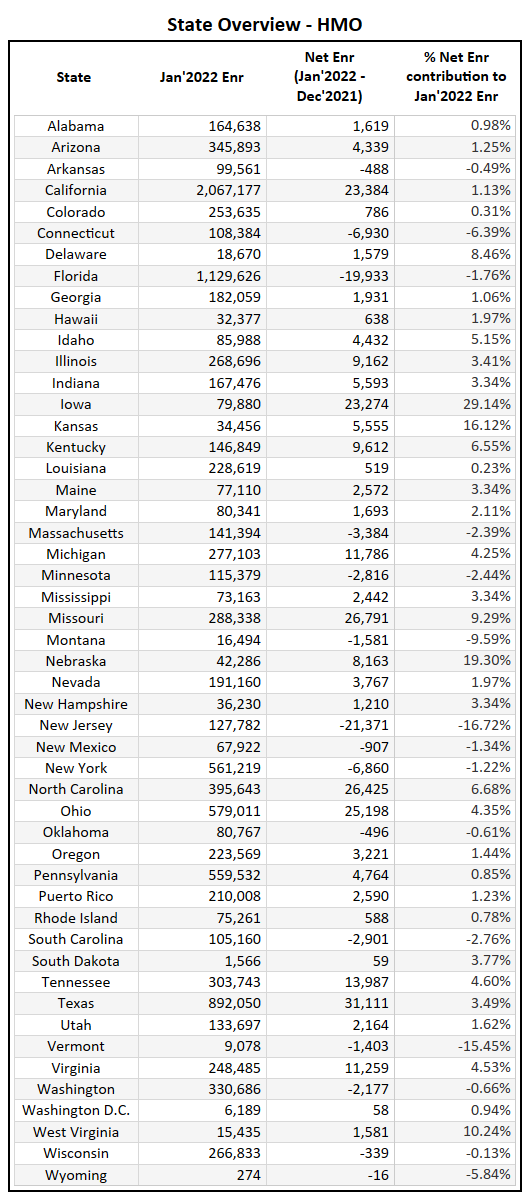

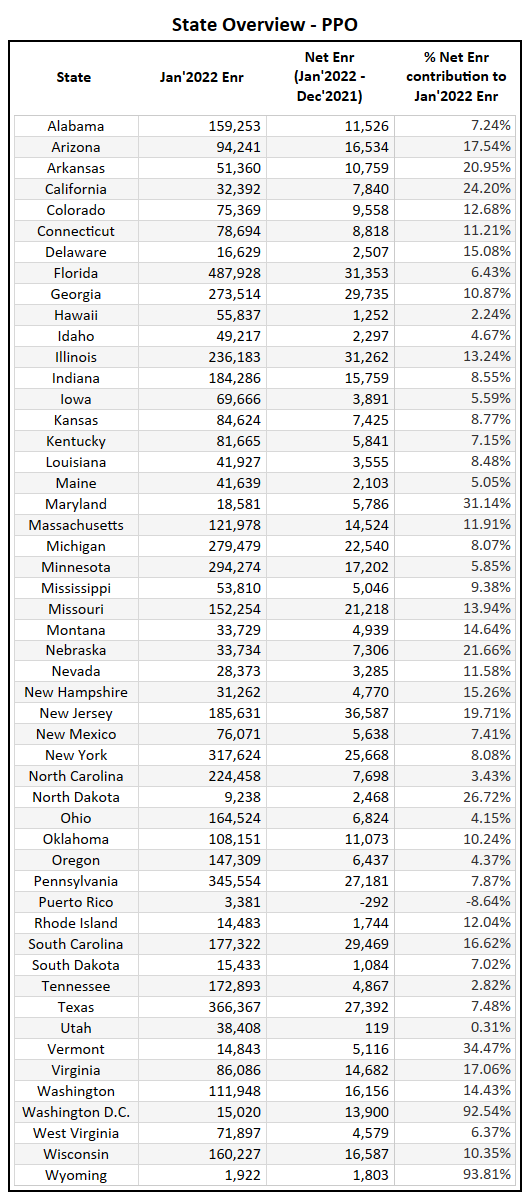

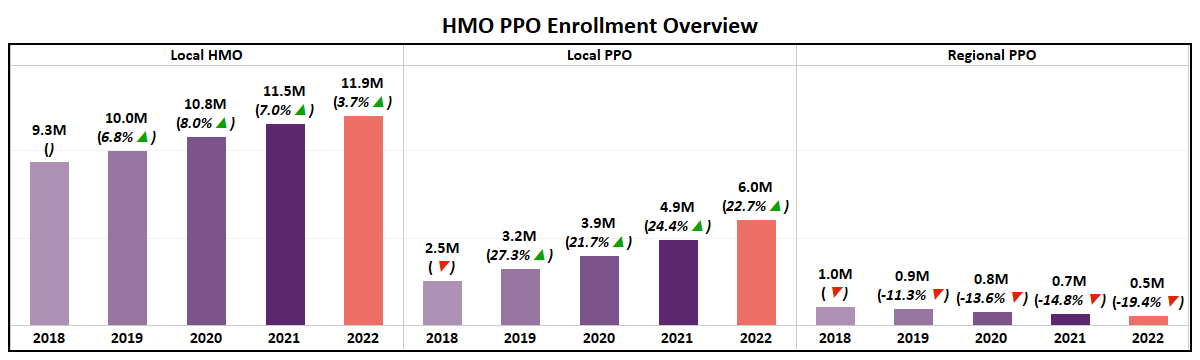

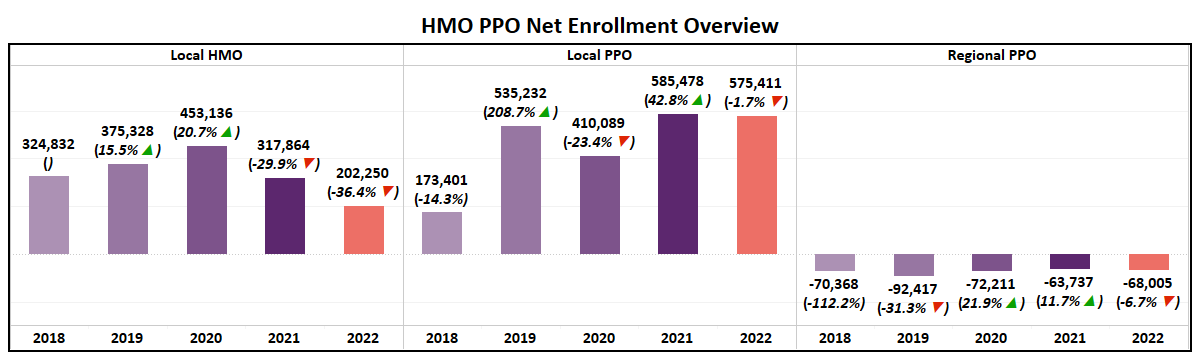

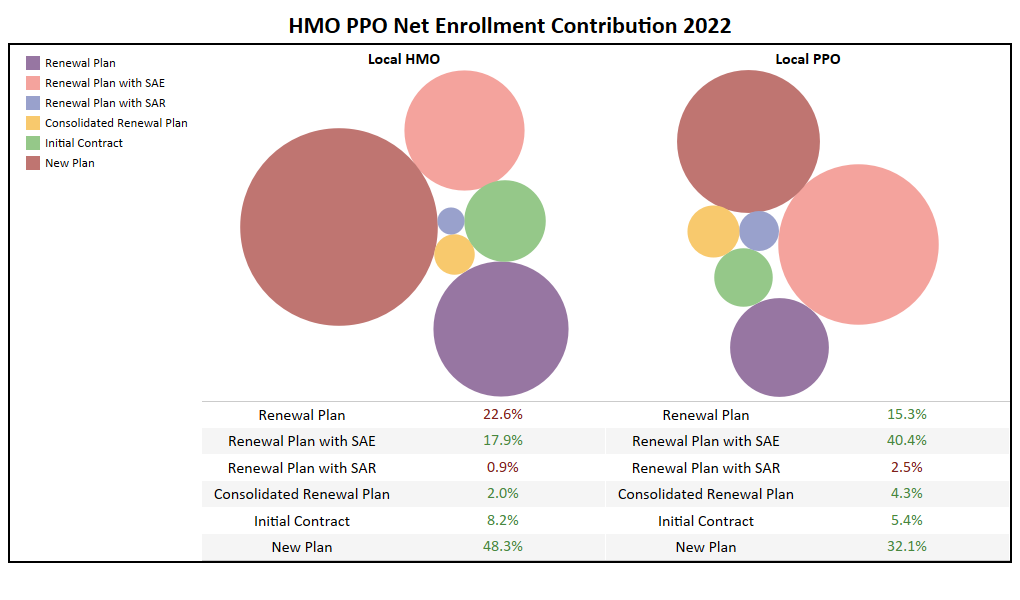

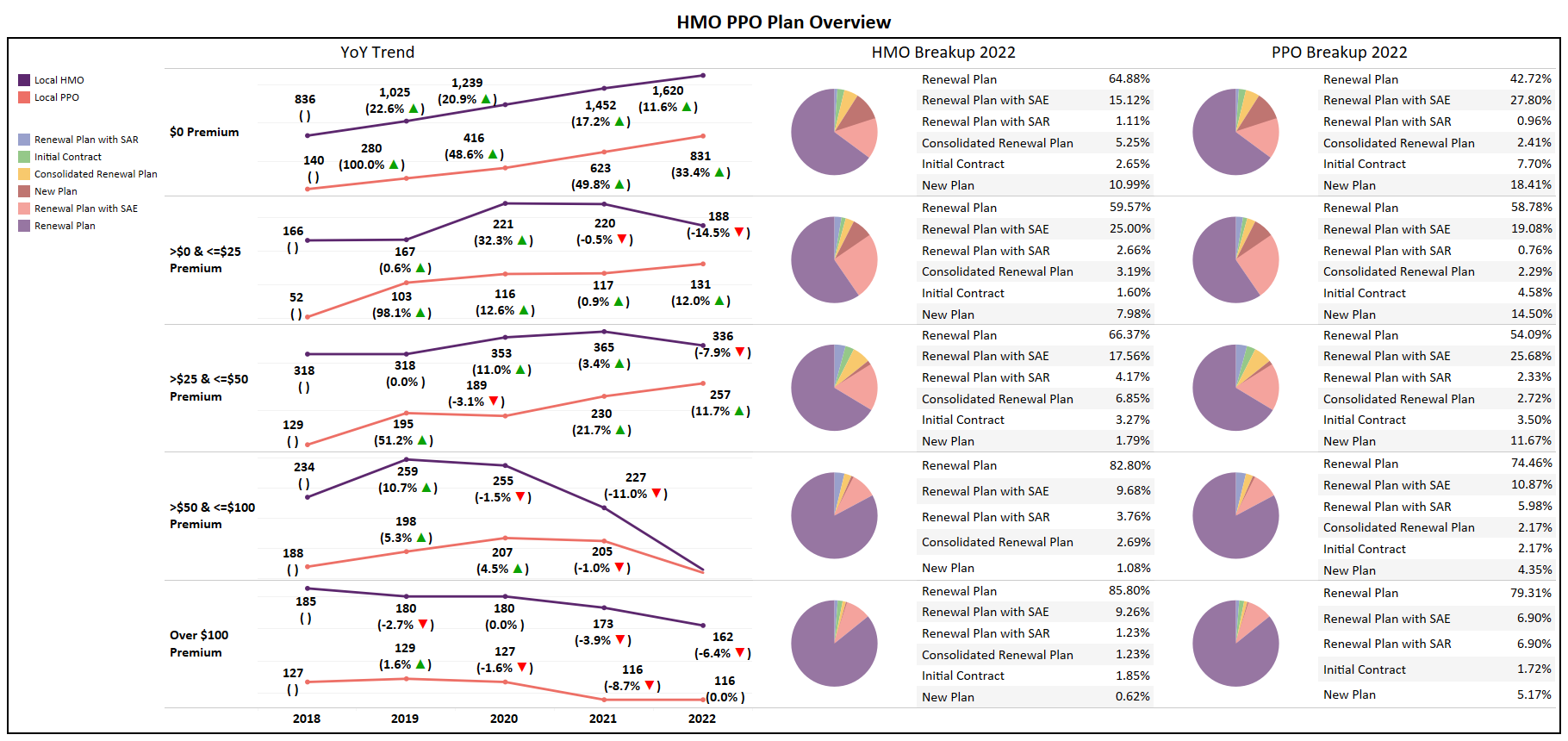

5.2 HMO PPO Enrollment Overview

-

While both HMO and PPO plans have witnessed YoY growth, PPO plans are growing at a much higher rate than HMO plans.

-

Regional PPO for a 5th year in a row has witnessed YoY loss.

-

Since 2021, HMO has seen a drop in YoY net enrollments, while PPO suffered a small drop in 2022.

-

Focusing on the net enrollment trend it’s clear that PPO plans are outperforming HMO plans by well over 300 thousand in 2022.

-

The falling trend in YoY net enrollments for HMO is mostly attributed to renewal plans, while new plans have performed well in comparison.

-

Service area reduction is the only segment where PPO plans have seen a small loss. Both new plans and service area expansions have performed well.

5.3 HMO PPO Highlights

-

California continues to dominate the HMO market with new plans.

-

New Jersey beat some of the big states to gain the highest net enrollment this AEP.

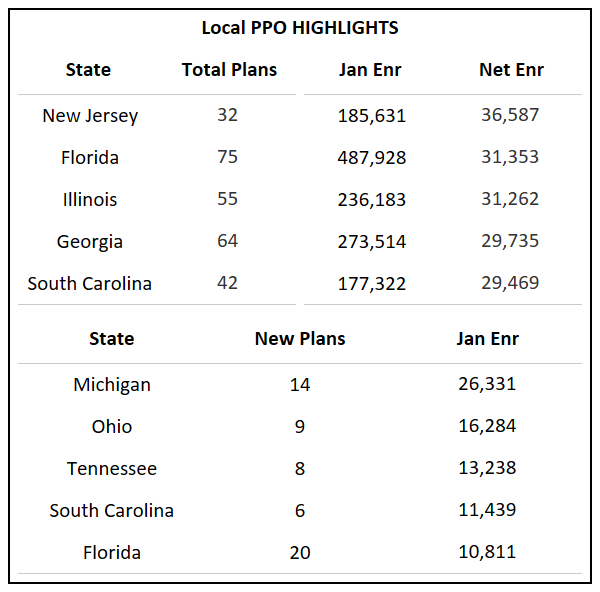

5.4 HMO PPO Premium Segments Overview

-

The zero-dollar premium segment of HMO is the only to see growth in total plans for 2022, while PPO plans saw growth in all segments below $50.

-

Zero premium plans have the highest percentage of new plans and initial contract for both HMO and PPO. However, PPO also has a good percentage in $0 to $25 and $25 to $50 premium buckets as well.

-

Both HMO and PPO plan breakdowns shows the highest percentage for renewal plans. However, renewal plans with service area expansion have shown good percentages for below $50 in both HMO and PPO plans.

-

Only in the zero-premium segment HMO saw a net growth in enrollment. This showcases the influence zero premium plans have on the market.

-

PPO plans saw positive net enrollment growth in all segments from $0 to $50. However, only in the zero premium segment has there been a positive YoY net enrollment gain.

-

Across all premium segments PPO plans have outperformed HMO plans in terms of net enrollment.

-

For HMO plans, every segment that witnessed a net enrollment loss was due to the various types of renewal plan.

-

New plans and initial contracts have witnessed positive enrollment gain across all premium segments for both HMO and PPO plans.

-

Except zero premium segment where most of the net enrollment growth was driven by renewal plans with service area expansion, all the positive net enrollment growth was driven by new plans for PPO.

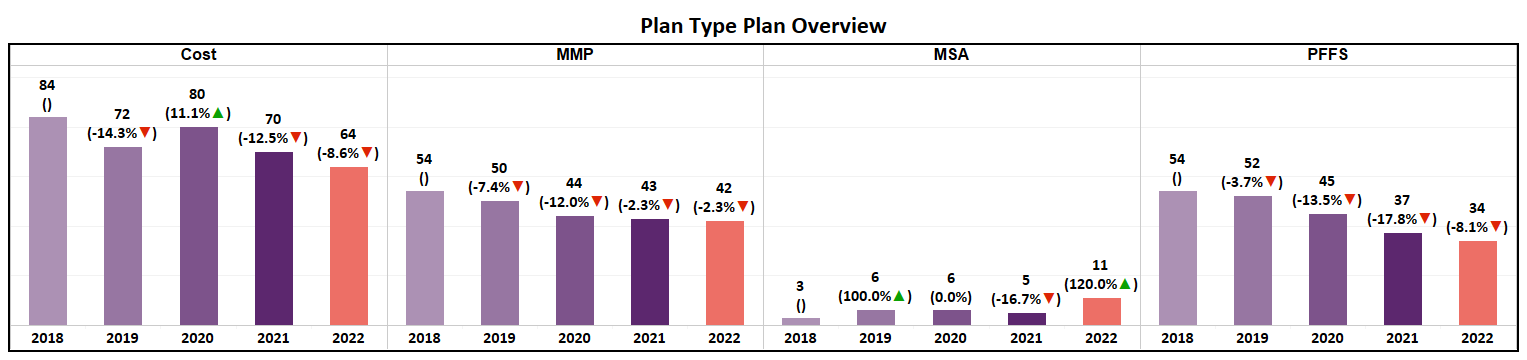

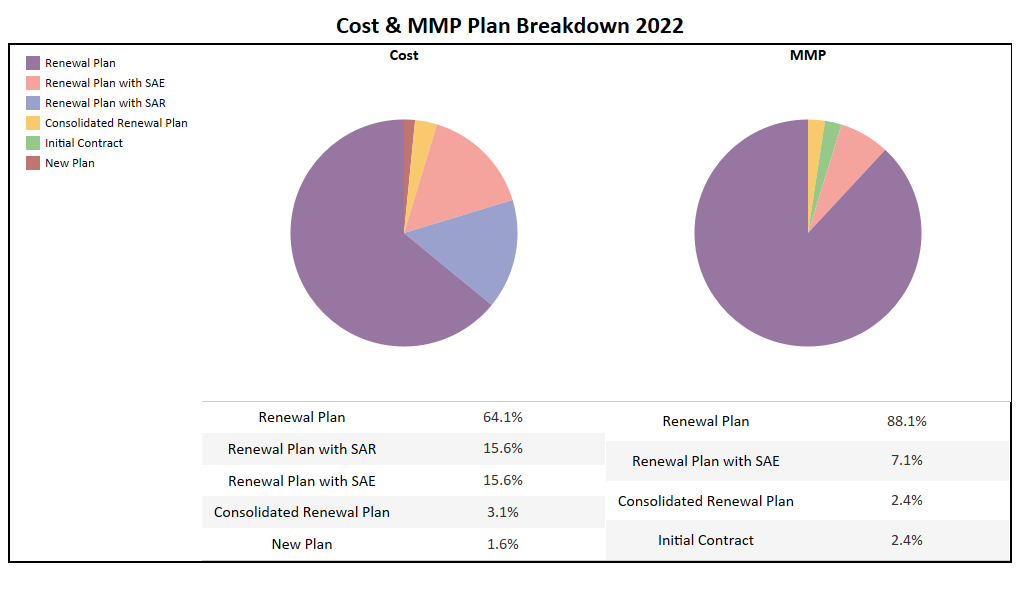

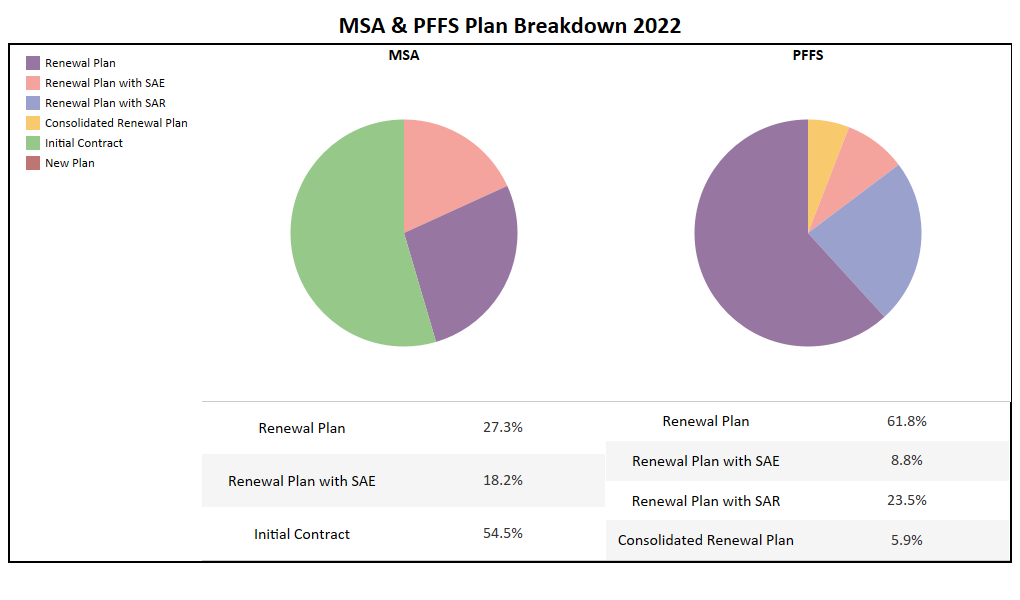

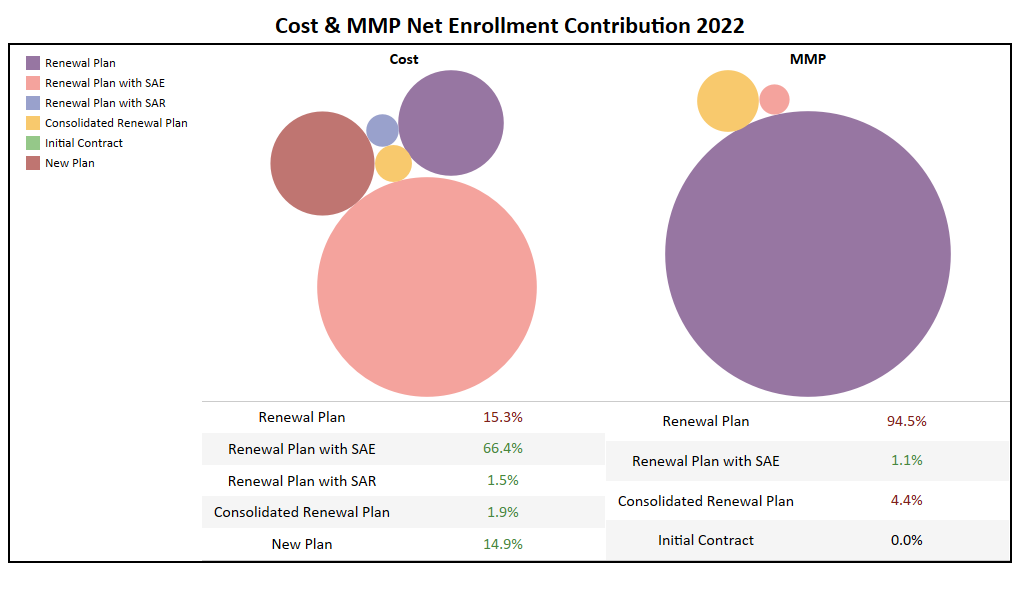

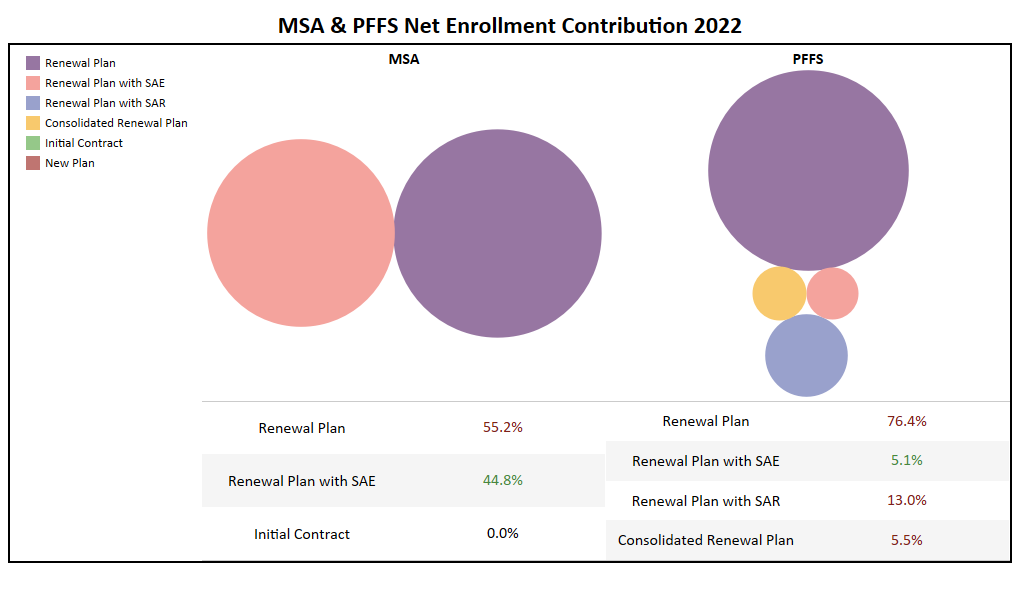

5.5 Other Plan Types Plan Overview

-

Among Cost, MMP, MSA, and PFFS, MSA is the only plan type to see growth while the rest have either dropped or remained stagnant.

-

Cost, MMP, and PFFS lean heavy towards renewal type plans with nearly all or most plans being renewal plans.

-

With very few plans being introduced both Cost and MMP are dependent on renewal plans for enrollment gains.

-

MSA is the only plan type with over 50% of the plans in 2022 being initial contract.

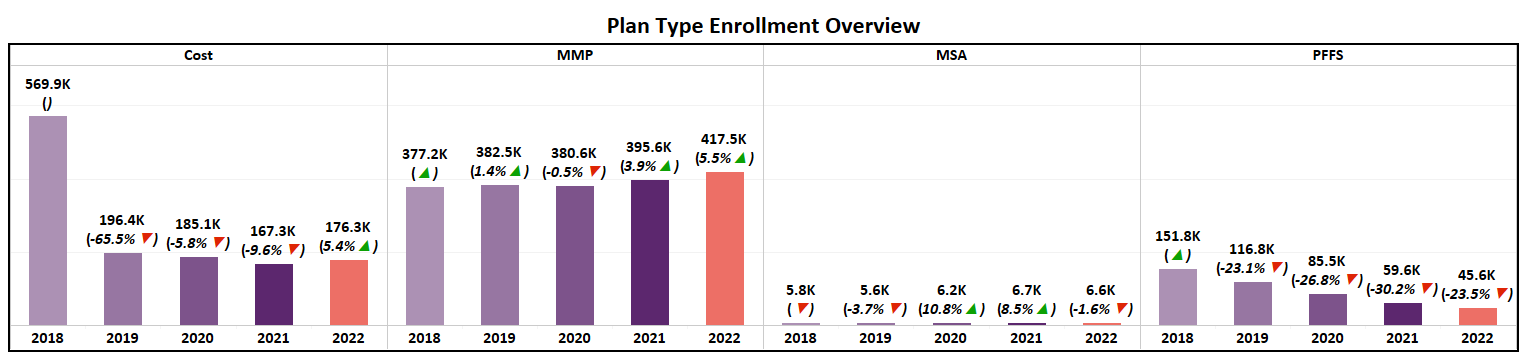

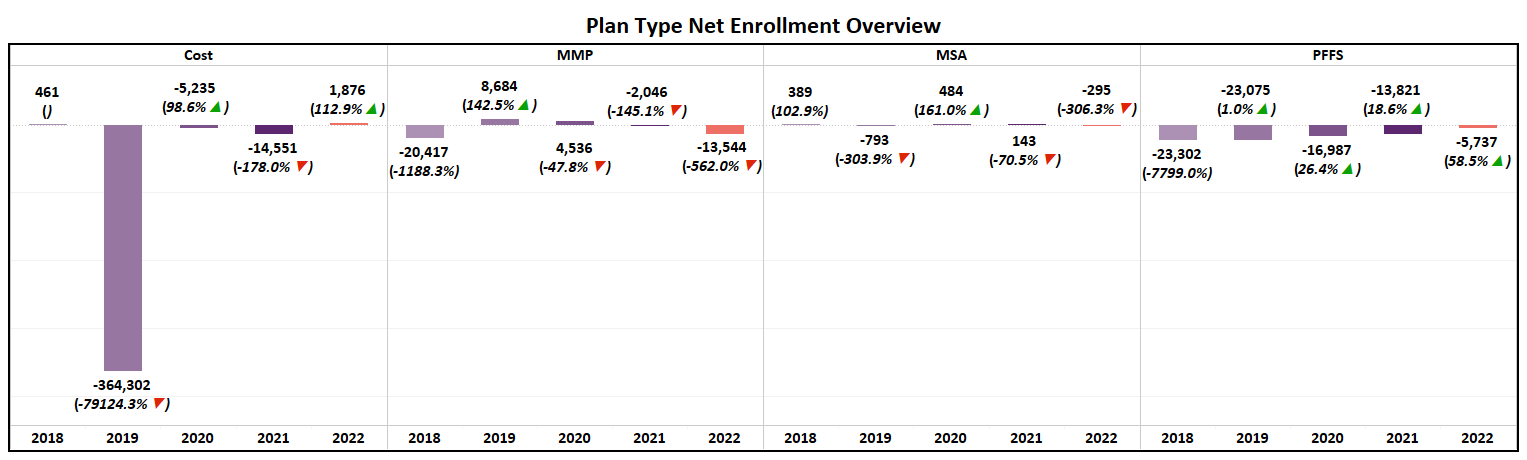

5.6 Other Plan Types Enrollment Overview

-

Cost and MMP saw a YoY growth in total enrollment while MSA and PFFS saw a loss in enrollments.

-

Looking at the net enrollment, Cost plan type is the only one to see a net growth in enrollment, while the rest witnesses a net loss.

-

The growth in cost was mostly driven by renewal plans with service area expansion.

-

Renewal plans and service area expansion plans performed equally well for MSA plans. However, the negative contribution of renewal plans outweighed the positive contribution of service area expansions plans.

-

The loss in net enrollments for PFFS was mainly driven by renewal plans.

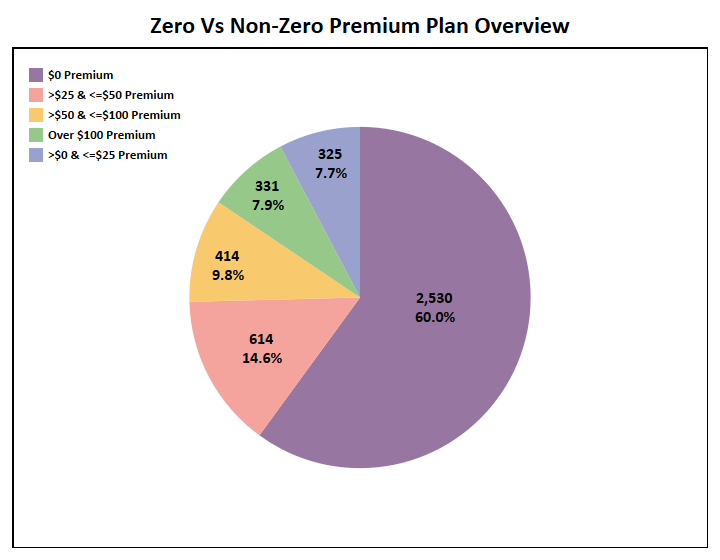

Premium Overview

6.1 Total Plan Overview

-

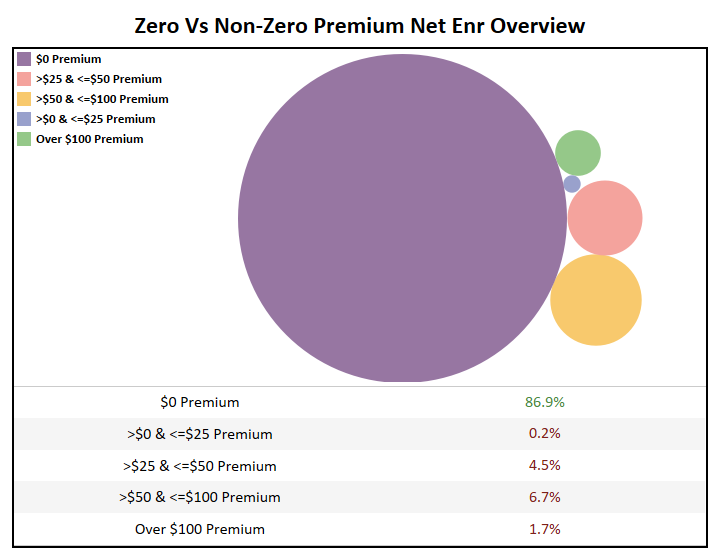

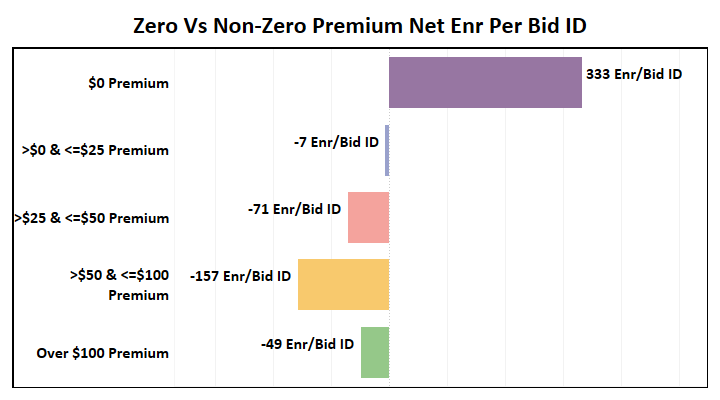

In 2022, zero premium plans dominated the non-SNP market, both in terms of bid id count and net enrollments.

-

No other premium segment had any positive contribution towards net enrollment.

-

On average zero premium plans gained an average of 300+ enrollments while $50 to $100 saw the biggest loss averaging around 150.

6.2 New Plan Overview

-

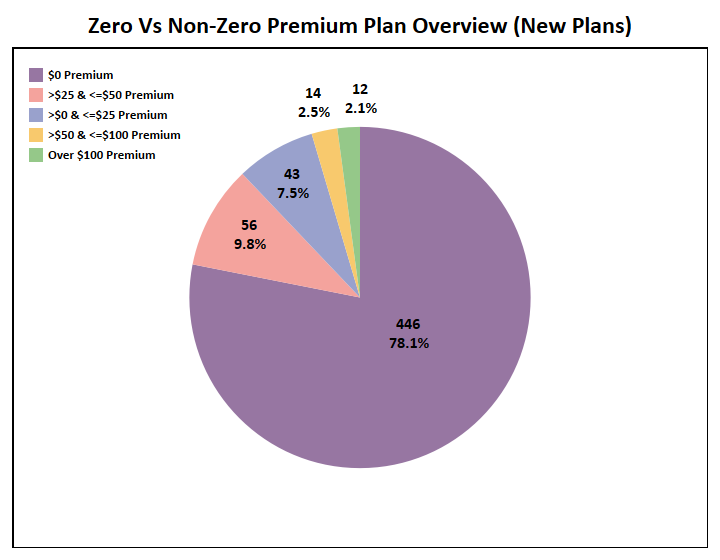

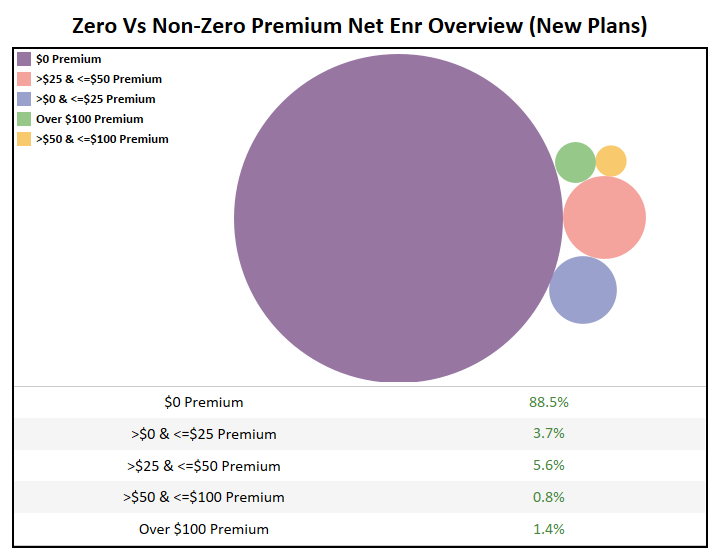

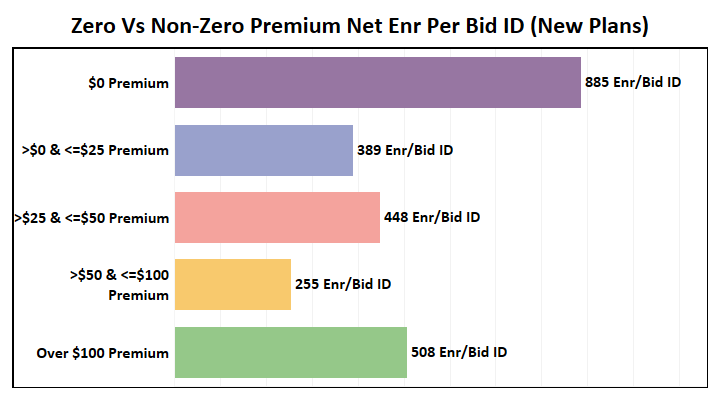

For new plans, zero premium again dominated, both in terms of plans introduced and enrollments gained.

-

Unlike the overall premium segmentation, new plan gained enrollments across all premium segments.

-

Over $100 segment beat every segment except zero premium segment in terms of average enrollment gain per bid id.

Drug Deductible Overview

7.1 Total Plan Overview

-

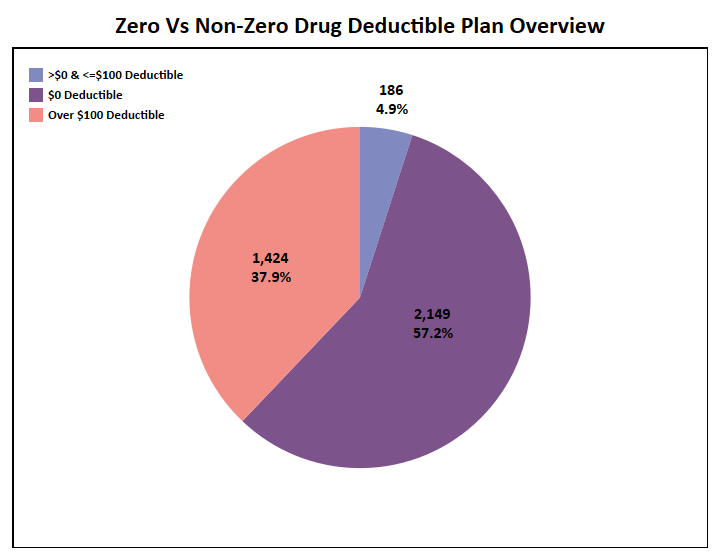

While zero drug deductible is the favored choice for payors, the market is split between zero and over $100 deductible.

-

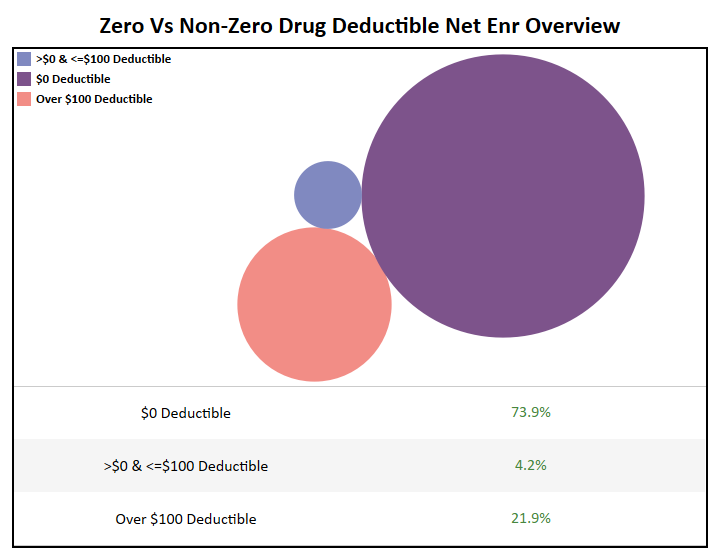

From a beneficiary view zero drug deductible is the clear winner, capturing over 70% of the net enrollment this AEP.

-

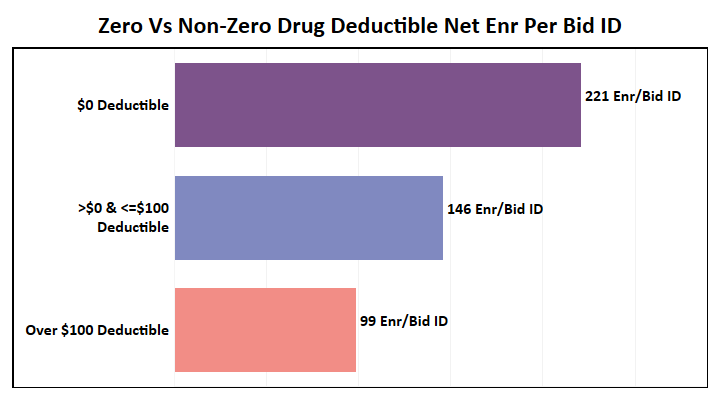

With over 200 enrollments per bid id, zero-dollar drug deductible plans have performed the best of all segments. At an overall level there is a clear preference for zero drug deductible plans.

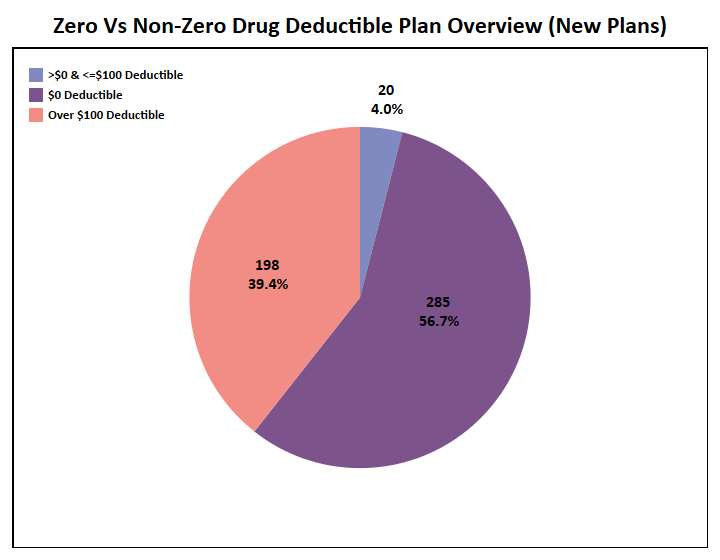

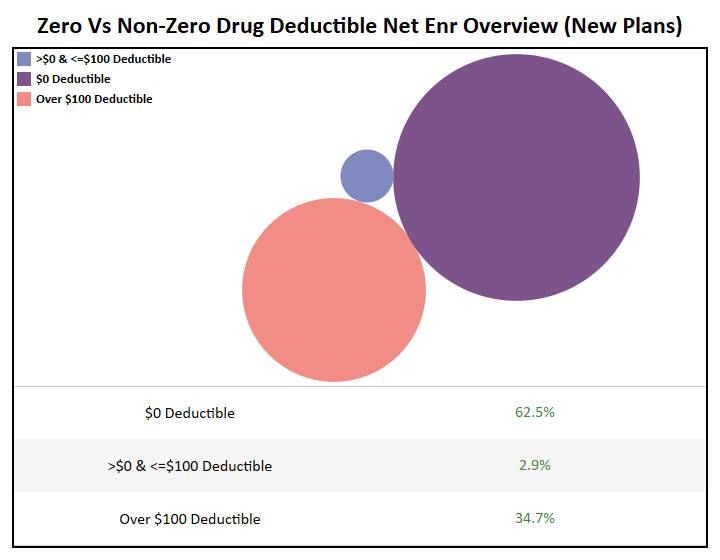

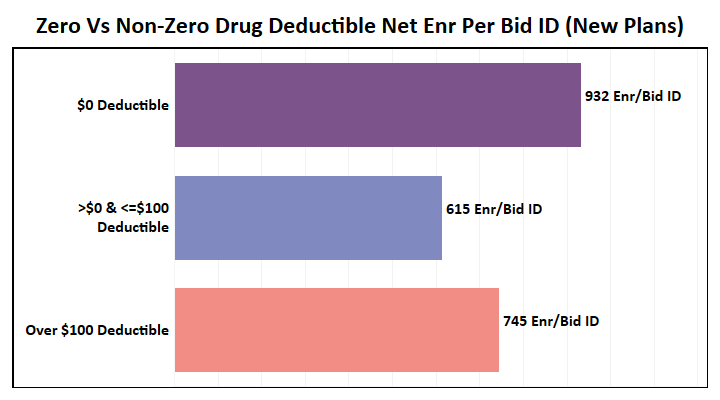

7.2 New Plan Overview

-

Like the overall level, the market is split between zero dollar and over $100 drug deductible.

-

Looking at the net enrollments, zero-dollar drug deductible plans have clearly performed well but looking at the enrollment per bid id, over $100 has still been able to capture an average over 700 net enrollments.

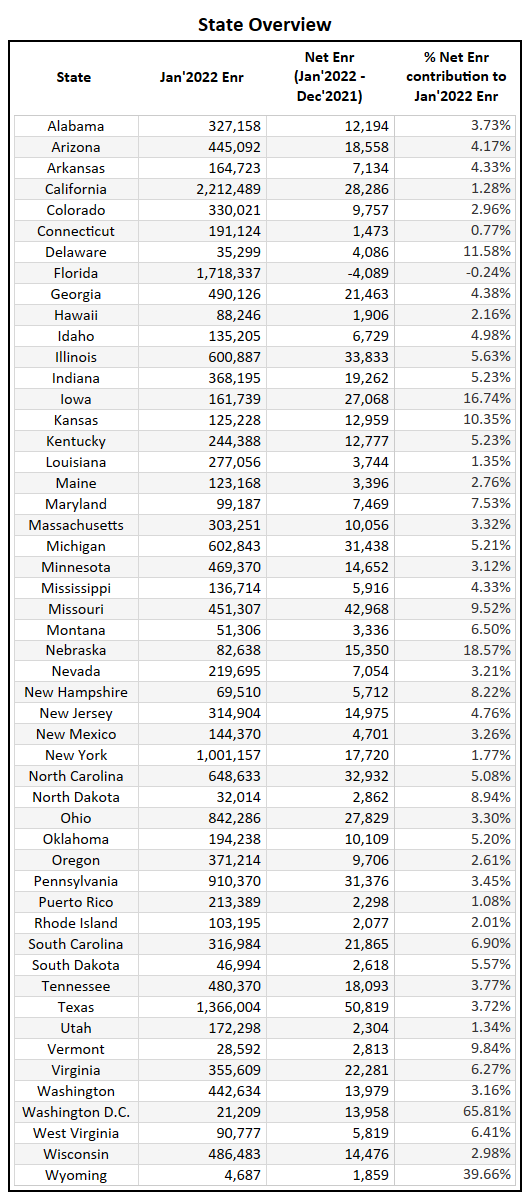

State Overview

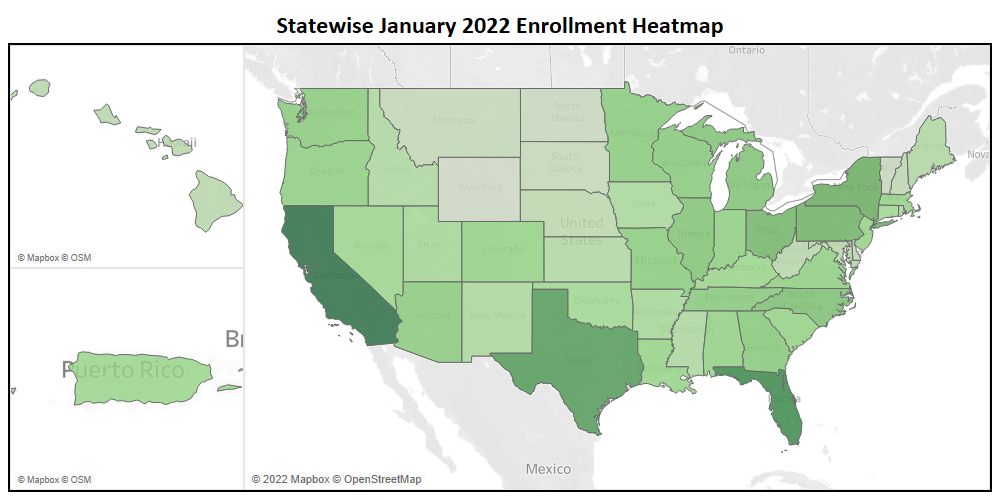

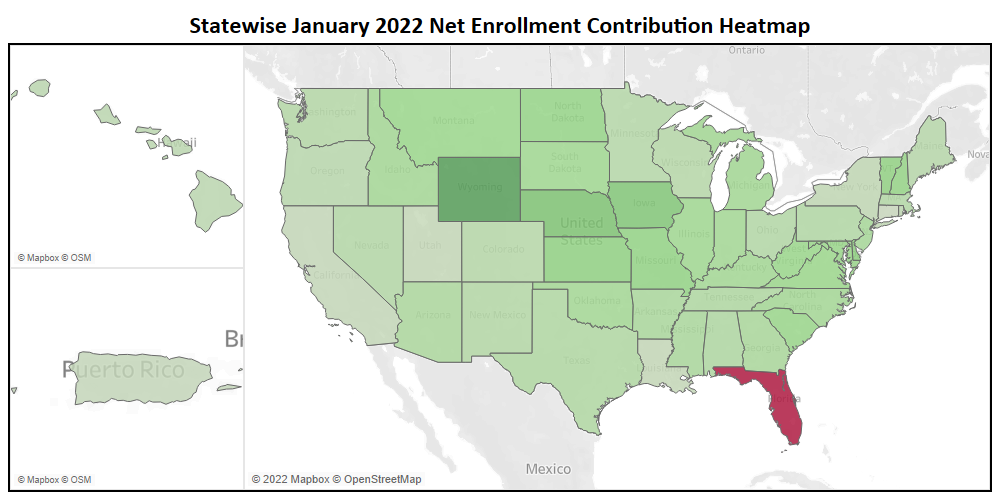

When we think about the top states in the country for Medicare Advantage, we tend to focus on total enrollments as the determining factor. In doing so we fail to identify emerging markets and instead focus on saturated markets with high populations. However, this can be a good starting point to evaluate potential shifts across the nation. The heatmap below shows us which states had the highest enrollment in January.

Unsurprisingly, California, Florida, and Texas have the highest total enrollment in the country, a position they have held for a while. Though these states have a high number of eligibles, entering such saturated markets will likely result in tough competition and high marketing investment for most organizations.

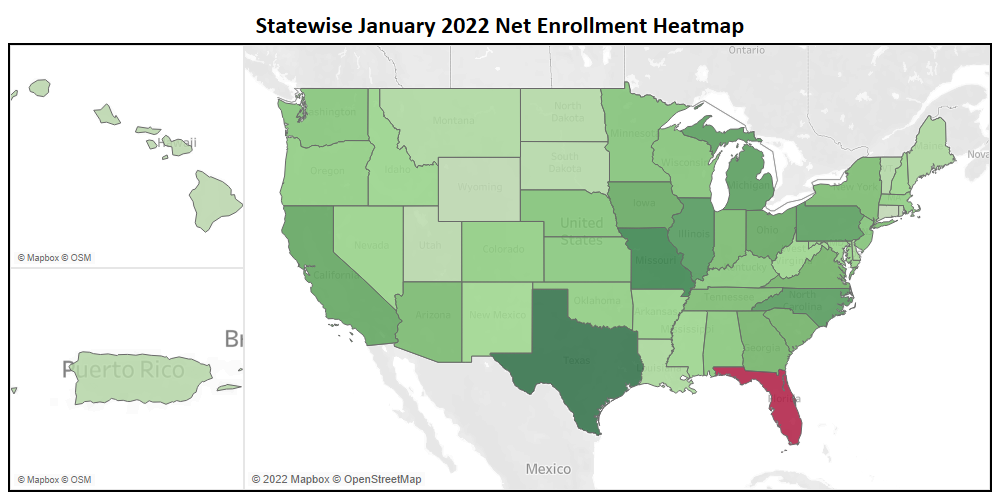

A different way to evaluate state-wise performance is to focus on markets with the highest net enrollments YoY. Doing so allows us to identify markets that are growing the fastest and often indicates saturated markets with high population coupled with high potential. While this helps shorten the list of true emerging markets, it also has challenges as these states are also typically highly contested markets with substantial competition. The heatmap below shows the states with the highest net enrollment gain from December 2021 to January 2022 (AEP impact). Texas, Missouri, and Illinois were the top three states in terms of net enrollment this AEP.

By altering our approach and calculating what percentage of the “total enrollment” was explained by the “net enrollment” we can better identify markets with high potential. This metric allows us to identify the states which are most active now and experiencing the highest growth relative to their size. We often refer to these as “emerging markets”. The heatmap below shows us emerging markets following the 2022 AEP.

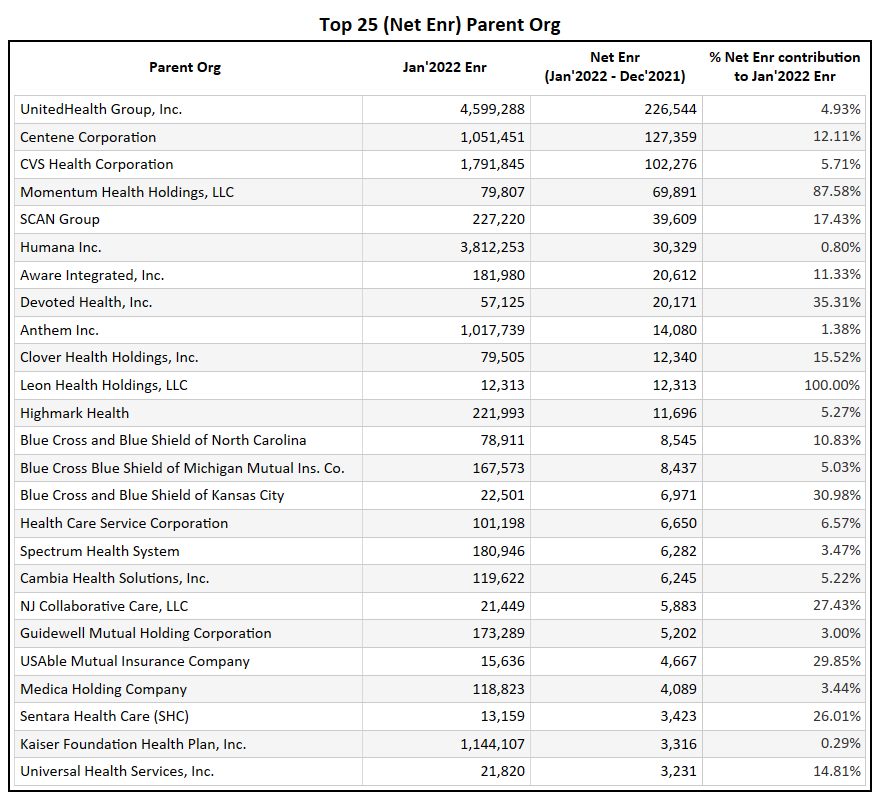

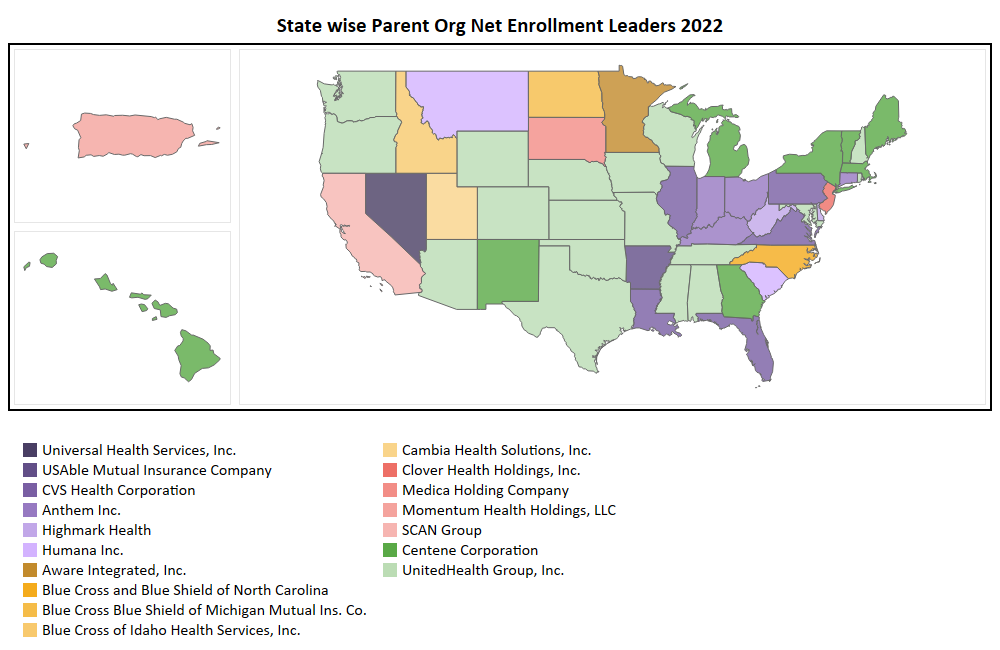

Parent Organization Overview

This section focuses on Payers, classified by their Parent Organization, at a national level. It is important to note that focusing on Parent Organizations at a National level is not an ideal way to gauge true performance. Multi-state Payers will always tend to have higher enrollment numbers even when they are not considered the best performers in their respective markets. Focusing on performance at the market level would allow us to understand the performance of Parent Organizations but is far too comprehensive for a general overview.

The below animation showcases how over the years United Health Group and slowly spread to become the top Payor in most of the states followed by Humana. However, there are a few states that dominated by Blue Cross Blue Shield Organization like Rhode Island and Alabama.

Appendix