Humana Investor Day 2025

Strategic Highlights for MA Leaders

June 16, 2025

Table of Contents

Summary

This overview condenses the key insights from Humana’s Investor Conference on June 16, 2025, featuring straight forward executive discussions and valuable Q&A takeaways, into actionable strategies specifically for Medicare Advantage (MA) insurers. As the sector grapples with heightened regulatory challenges, fluctuating star ratings, and evolving market conditions, we provide these insights to equip MA executives with the foresight to adjust strategies and make well-informed choices for 2026 and the future.

Humana’s core message was unambiguous: it aims to construct lasting value, not merely pursue volume. By streamlining its portfolio, focusing on margin-driven plan architecture, recalibrating geographic presence, and expanding CenterWell, the company is activating every strategy for enduring sustainability. This document presents a high-level analysis of these transformations, enabling MA stakeholders to evaluate, respond, and strategize with assurance.

Insights From Q&A Session From Humana Leadership

1. Stars Ratings & Medicare Advantage Strategy

High Priority – Core to Humana’s Competitive Position & Financial Recovery

Stars Revenue Impact & 2028 Outlook

Stars improvement assumed to generate $1B–$1.4B in revenue uplift; aiming for top quartile performance (10% above peer median) by 2028.

Celeste Brown

CFO

James Rechtin

President, CEO, & Director

Progress Toward Bonus Year 2027

Confident in metrics aligning to projections; year-over-year internal improvement noted.

Lisa Stephens

COO - Insurance

Group MA Diversification & Recontracting

Strategy involves placing groups on 4-star contracts; renewal activity is strong, especially in Alabama.

Lisa Stephens

COO - Insurance

George Renaudin

President-Insurance

Quartile Definition & Peer Group

Peer group includes United, CVS, Elevance, Centene, and Cigna; top quartile = 10% better than median.

James Rechtin

President, CEO, & Director

2. Financial Outlook & Guidance

High Priority – Investor Confidence & Growth Expectations

2028 Margin & Earnings Targeting

MA margins expected to double by 2026 (vs. 2025); OpEx leverage will be more prominent in later years.

Celeste Brown

CFO

2025 Guidance & Trend Commentary

Trends consistent with forecasts; Q2 earnings update will provide revised guidance.

Celeste Brown

CFO

George Renaudin

President-Insurance

Post-2028 EPS Growth

Expectation of double-digit EPS growth beyond 2028; current plan extends several years out.

Celeste Brown

CFO

Medicare Margin Cadence Through 2028

Material margin improvement expected in 2027 and 2028 from Medicaid growth curve.

Celeste Brown

CFO

3. Clinical Excellence & Value-Based Care (v28 Response)

Medium to High Priority – Operational Resilience

v28 Impact & PCO Resilience

PCO adopted a 3-year recovery strategy; integration and platform standardization credited for success.

Sanjay Shetty

President of CenterWell

Renee Buckingham

President of CenterWell Primary Care

Strategic Vision for Value-Based Care

No shift in philosophy post-v28; committed to clinical outcomes and sustainable models.

All Executives

Provider Performance Headwinds

Providers are under pressure, but CenterWell is acquiring and absorbing lower-performing groups.

James Rechtin

President, CEO, & Director

George Renaudin

President-Insurance

4. Bid Strategy, Membership, and Margin Management

Medium Priority – Market Positioning

2026 Bids and Margin Recovery

2026 strategy focuses on stability and margin, not aggressive benefit investment.

George Renaudin

President-Insurance

Avoiding Outlier Positioning

Goal is to avoid being an outlier on benefits—previous outlier status impacted retention.

Celeste Brown

CFO

Expected Enrollment Growth

Range not provided, but margin prioritized; excess growth not expected.

James Rechtin

President, CEO, & Director

George Renaudin

President-Insurance

5. Pharmacy Strategy & IRA Impact

Medium Priority – Operational Efficiency & IRA Policy Readiness

Outsourcing & Scale Benefits

Initial skepticism overturned; Humana PBM performs well due to MA scale and single formulary.

James Rechtin

President, CEO, & Director

Sanjay Shetty

President of CenterWell

IRA Drug Trend & 2026 Bidding

2025 trend playing out as expected; 2026 guidance cautious given demo uncertainties.

George Renaudin

President-Insurance

6. Organizational Change & Talent Strategy

Lower Priority – But Critical to Execution

Talent Infusion & Culture

New leadership from outside industries blending with internal talent for transformation.

James Rechtin

President, CEO, & Director

Celeste Brown

CFO

Program Management Office

Tracking and managing transformation projects; focus on clinical and G&A initiatives.

All Executives

Strategic Alignment Across Units

Shared vision across PCO, Insurance, and Pharmacy; AI and digital seen as enterprise tools.

Sanjay Shetty

President of CenterWell

7. Regulatory & Risk Adjustment

Lower to Medium Priority – Compliance & Risk Management

CMS Memo on Code Deletions

Processes in place to review and delete unsupported codes; timelines seen as tight.

Lisa Stephens

COO - Insurance

George Renaudin

President-Insurance

In-Home Evaluation Policy & IOGS

Advocating for continued use of IOGS; strong follow-up processes to tie diagnosis to care.

James Rechtin

President, CEO, & Director

Lisa Stephens

COO - Insurance

Insights From Q&A Session

Medicare & Medicare Advantage (MA) Discussion

- Core Focus: Humana reaffirmed its identity as a senior healthcare services company, with ~90% of revenue and most of its earnings from Medicare Advantage (MA).

- Importance of MA: MA remains critical to Humana’s success—if it doesn’t work, the rest of the business suffers.

- Sector Attractiveness: MA remains an attractive, bipartisan-supported sector with strong demographic tailwinds, better health outcomes than FFS Medicare, and sustained growth potential.

- MA Margin Focus: A strategic pivot toward sustainable, stable MA margins by focusing on clinical excellence and operating leverage rather than primarily on benefit structure.

- Stars Ratings: Stars performance remains important, but Humana is broadening its focus to include overall clinical outcomes and service quality.

Growth Strategy

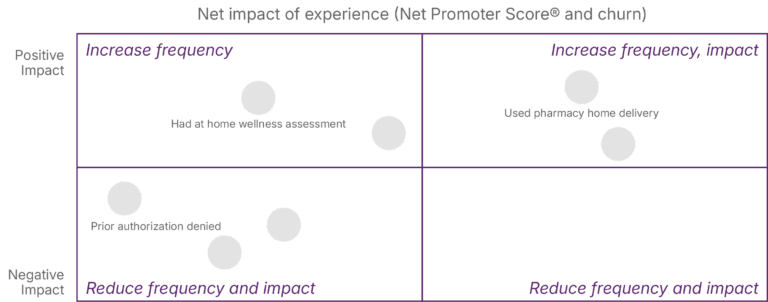

- Emphasis on retention-led growth, narrowing the benefit gap, and optimizing distribution and service excellence for long-term performance.

Financial Outlook & Operating Leverage

- Earnings Power: Humana is operating at a fraction of its true earnings power and plans to unlock it via operating levers like clinical excellence and admin efficiency.

- Stars Planning: Humana is conservatively forecasting Stars results for 2026–2027, assuming potential losses in litigation and challenging benchmarks.

- 2025–2028 Growth Plan: Targets a step-up in earnings through: Clinical excellence (improved outcomes & cost reduction) Operating leverage (tech-enabled efficiencies)Medicaid and CenterWell expansion.

- Margin Strategy: Margin improvements will be driven by better diagnosis accuracy, provider engagement, and clinical innovations (e.g. site-of-care optimization).

- Capital Allocation: Reinvestment in Medicaid and CenterWell seen as highest-yield opportunities, reinforcing the MA core.

Other Key Business & Growth Drivers

- CenterWell: Central to Humana’s evolution into a consumer healthcare company; delivers integrated care and supports better MA outcomes.

- Medicaid: Viewed as strategic and synergistic with MA. Humana has grown to 1.6M Medicaid members, with expansion into key dual states (FL, LA, GA, MI, VA, IL).

- Value-Based Care: Investing heavily in upstream, proactive programs like ESRD/CKD value-based models and site-of-service optimization (e.g. more ASCs for joint replacements).

- Group MA: ~$8.5B business; facing margin reset but supported by strong service (97% retention) and Stars contributions.

- Supplemental Lines: Includes PDP, MedSupp, and specialty—support cross-sell and member retention, enhancing enterprise value.

Humana Investor Day Conference Summary

1. Medicare Advantage: An Attractive and Growing Sector

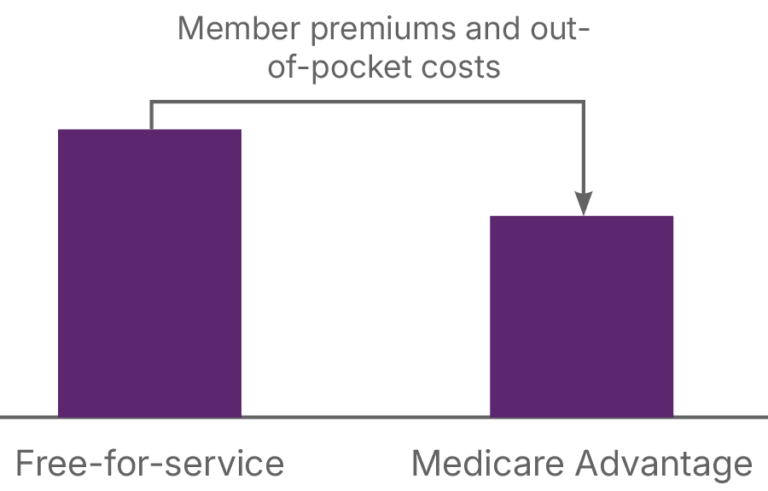

Higher quality, lower cost:

MA plans deliver better health outcomes and preventive care than Fee-for-Service (FFS) Medicare.

$2,000 annual savings:

On average, MA beneficiaries save ~$2K annually in premiums and out-of-pocket costs compared to FFS.

~$2K

annual savings in member premiums and out-of-pocket costs

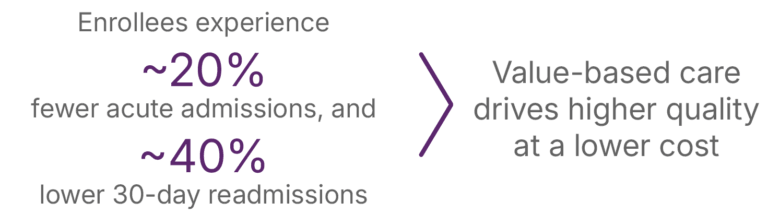

Better health results:

20% fewer acute hospital admissions 40% lower 30-day readmission rates

90% of HEDIS measures outperformed relative to FFS.

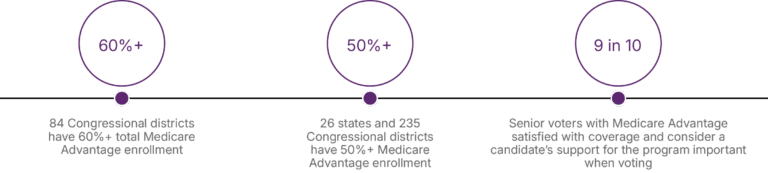

Strong bipartisan support:

MA has growing political backing — over 50% of seniors and 60%+ of districts have high MA enrollment.

2. Market Growth Drivers

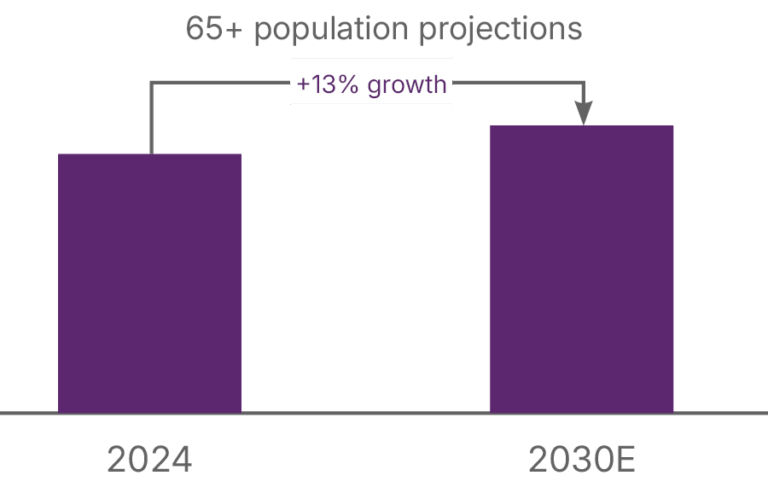

Demographic shift:

13% growth in the 65+ population expected from 2024 to 2030.

Medicare Advantage

expected to grow

~9M

members by 2030

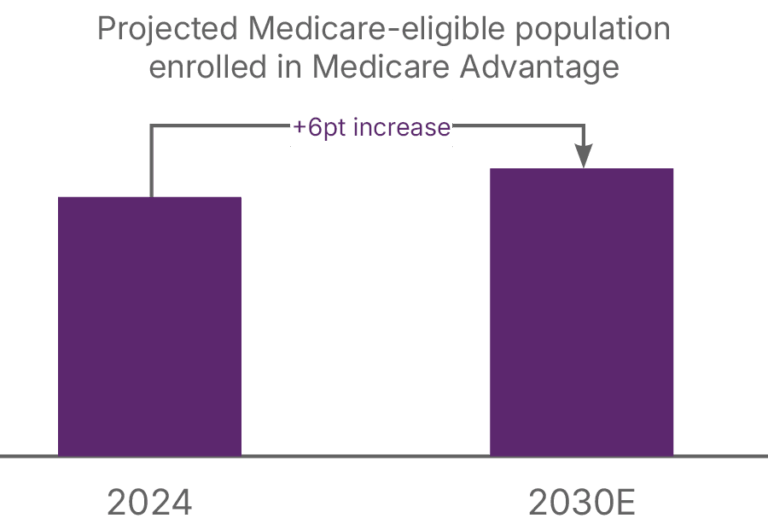

MA penetration rising:

Expected to increase by 6 percentage points by 2030, adding ~9 million enrollees. Sustained multi-year member growth expected as margin stabilizes.

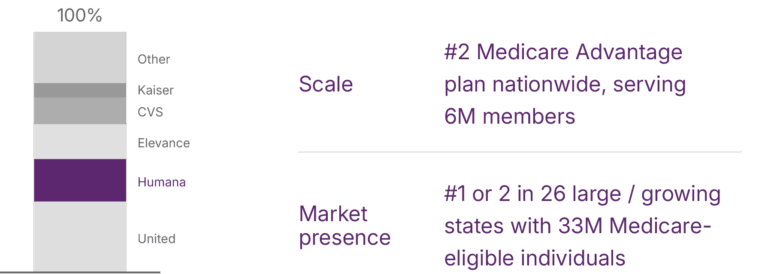

3. Humana’s Position in MA

- #2 national MA plan, serving 6M members.

- #1 or #2 in 26 states representing 33M Medicare-eligible people.

- Strong focus on clinical excellence to improve Stars ratings and reduce costs.

- Aiming to achieve top quartile Stars performance (10% above peer median) by 2028.

4. Growth Strategy and Margin Expansion

Core strategy for MA growth:

- Customizing benefits by segment

- Simplifying and stabilizing plan benefits

- Enhancing onboarding and customer experience

- Investing in clinical excellence and data-driven care

Targeting 3%+ pre-tax margin in individual MA.

Projected 6–8% CAGR growth in underwriting margin by 2028.

Retention improvements (25–35 bps) expected to drive margin gains.

5. Integration with CenterWell and Medicaid

CenterWell (Primary Care, Pharmacy, Home Health) supports MA by improving outcomes and reducing costs:

- 10%+ fewer hospitalizations for members using CenterWell services.

- Strong medication adherence and better care navigation.

Medicaid expansion complements Dual Eligible SNPs (D-SNPs) and is expected to become a significant value contributor by 2028.

6. Long-Term Margin Sustainability

Despite regulatory and Stars-related challenges in 2026–27, Humana expects to return to strong performance by 2028, enabled by:

- Margin expansion via operating leverage and cost transformation

- Growth in member volume and plan quality

- Consistent capital allocation and Stars improvement

Related Case Studies

-

National MA Plan Uses NetworkIntel to Analyze 400+ Networks, Identifies Gaps, Saves 8 Months, Boosts Contracting & DSNP Strategy06 May 2025 Case Study

National MA Plan Uses NetworkIntel to Analyze 400+ Networks, Identifies Gaps, Saves 8 Months, Boosts Contracting & DSNP Strategy06 May 2025 Case Study -

Payer Faced Challenges: High-Cost Provider Risk, Adverse Selection Benchmarking & Slow Claims/Competitor Analysis Insights16 Dec 2024 Case Study

Payer Faced Challenges: High-Cost Provider Risk, Adverse Selection Benchmarking & Slow Claims/Competitor Analysis Insights16 Dec 2024 Case Study -

Payer Faced Cost Pressures & Forecasting Issues, Hindering Enrollment Planning & Product Strategy Amid Value-Based Care Shift16 Dec 2024 Case Study

Payer Faced Cost Pressures & Forecasting Issues, Hindering Enrollment Planning & Product Strategy Amid Value-Based Care Shift16 Dec 2024 Case Study