Pennsylvania

Landscape insights this AEP

- October 8, 2025

- 7 min read

Pennsylvania: The Growth Story

While most states contract, Pennsylvania adds 92 plans in 4 years.

Plans Added

Since 2022

Active Payers

+2 from 2025

Counties

Full Coverage

Plans in Lancaster

Most in USA

4-Year Expansion Trajectory

Sustained growth every year

+38% Total Growth

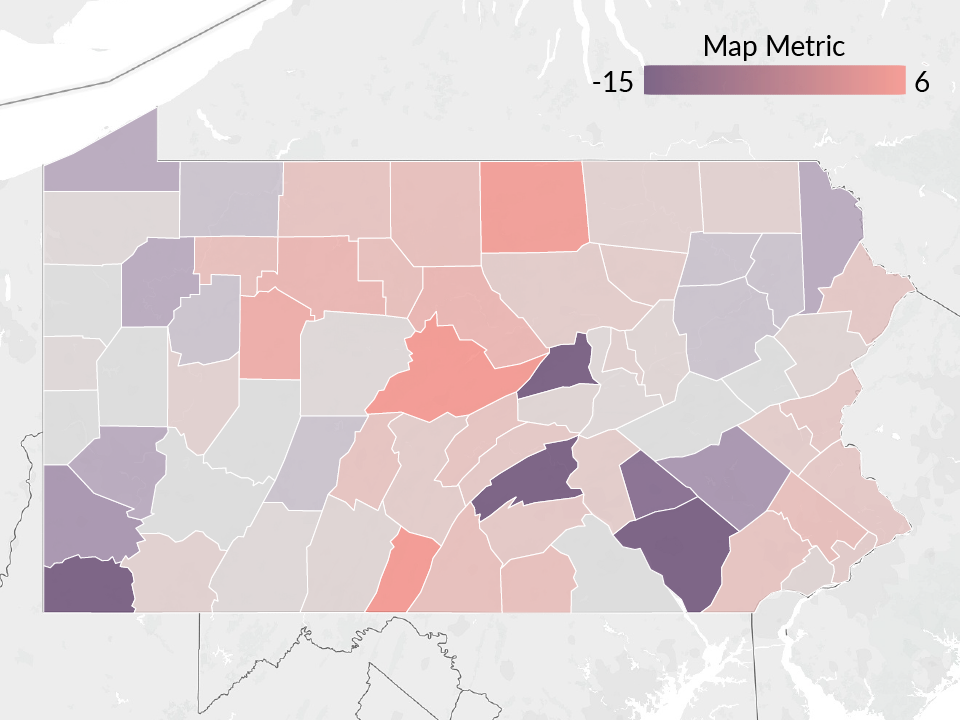

Geographic Moves

County-level changes

Devoted Health

Now in 53 of 67 counties

Universal Coverage

5 Major Payers

- UnitedHealth Group

- Humana

- Highmark Health

- CVS Health

- Independence Health

Plan Type Mix

2026 Distribution

HMO Surge

Fastest growing segment

Market Leaders

By plan count

Highmark Health

Optimizing

CVS Health

Selective Focus

UPMC Health

+5 Plans

Member Costs

2026 Averages

Average Premium

Monthly

Max Out-of-Pocket

Annual

Cost Distribution

Drug Deductibles

Sharp increase

HMO Surge

+81% from $233

$0 Deductible Plans

Down from 48%

Plans Over $600

of 253 non-zero-drug deductible

Why It Matters

Pennsylvania's unique market dynamics

#3 Growth State

+16 plans in 2026 alone

HMO Dominance

186 plans, +27% growth

Premium Market

$30.40 average monthly

While most states see contraction, Pennsylvania proves growth is still possible with the right strategy

+38% 4-Year Expansion

Why HealthworksAI

Be first. Be right. (Not either/or)

Fastest signal → action

- Landscape <36h, PBP/Crosswalk 48h

- Enrollment Forecast 96h (91.2% benchmark)

County precision, not averages

- Defend/Grow/Shrink maps, broker targets

- One-pagers so field teams act where shelf space just opened

Benefits that actually convert

- Benefit sensitivity quick-tests by ZIP (Rx, dental $, flex, utilities) to reallocate budget from low-ROI perks to high-lift levers

20-min readout: top counties, rival moves, benefit levers, commission signals.

Insights from CMS Landscape (<36h turnaround)