Q2 2025 Earning Insights: Elevance Health

- July 17, 2025

- Elevance Health Earnings Release Q2 2025

Looking for deeper analysis?

Our Consolidated Earnings Report offers expanded insights across all major payers and is available to subscribers and clients.

Table of Contents

Summary

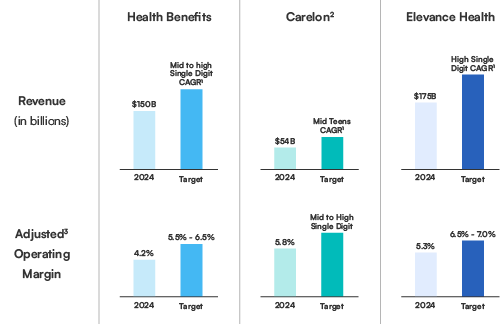

Elevance Health’s Q2 2025 showcased resilient revenue growth but mounting cost pressures. Revenue rose 14% YoY to $49.4B, driven by premium increases, acquisitions, and Medicare Advantage (MA) expansion. However, net income fell 24% to $1.7B as medical costs soared in ACA and Medicaid lines, eroding margins and prompting a reduction in full-year earnings guidance. The medical loss ratio climbed to 88.9% from 86.3% due to persistently high ER and behavioral health utilization, especially among Medicaid and ACA members.

Elevance furthered its strategic emphasis on technology by enhancing AI and value-based care initiatives to mitigate risk and improve member outcomes. Membership experienced a shift: while numbers in Medicaid and ACA plans declined, there was growth in MA and risk-based commercial policies.

The Carelon division contributed to business diversification with a 35.8% revenue increase, driven by acquisitions and service expansion.

Key Executive Quotes:

Margin Pressures and Operational Response- ACA and Medicaid Sectors

Elevance Health faced ongoing medical cost challenges in both the ACA and Medicaid sectors, prompting downward earnings revisions and a broad push for operational efficiency.

Leadership Quotes:

“We know this adjustment is disappointing, and we’re taking concrete actions to address it. Our focus is on execution, making the right decisions now to strengthen the business and position Elevance Health for long-term sustainable performance.”

Gail Boudreaux, CEO, Q2 2025 Earnings Call

“While the external environment continues to evolve, we are focused on the areas within our control—managing healthcare costs, deploying targeted investments in advanced technology and value-based care delivery, and reinforcing the operational foundation that supports long-term value creation.”

Gail Boudreaux, CEO, Statement via Morningstar

“Our strategy remains grounded in delivering whole health solutions that are simple, affordable and personalized...The actions we’re taking are designed to stabilize trend, improve pricing alignment and restore operating leverage over time.”

Gail Boudreaux, CEO, Q2 2025 Earnings Call Transcript

Provider Network Adaptation and Market Realities

Elevance Health, like its peers, faces new provider network challenges brought on by shifting reimbursement models, mounting cost pressures, and increased regulatory oversight.

- Network Strain: Rising medical cost trends and aggressive billing by some providers (including dispute escalation via No Surprises Act mechanisms) sharpen tensions around contract negotiation and network composition.

- Local Market Leverage: Elevance relies on its concentrated local market share to enhance bargaining power in provider negotiations. This approach enables more meaningful value-based arrangements but can exacerbate disputes where market share is high.

- Value-Based Partnerships: Executives indicate ongoing investments in clinical partnerships, with a focus on shared expertise, advanced care collaboration, and business integration to reduce administrative burden and boost care quality.

Leadership Quotes:

“We’re proactively aligning our network strategy with the trend environment—ensuring renewal and provider contracts reflect current cost structures.”

(Q2 2025 Earnings Call) Reporting by Investing. Mark Kaye, CFO, Elevance Health

“Meanwhile, some providers are also billing more aggressively including through the dispute resolution process set up by the No Surprises Act, a concern that led Elevance to sue two Georgia providers and their billing company in May.”

Reporting via Healthcare Dive

Regulatory and Reimbursement Uncertainty

Elevance leaders addressed the unpredictability of regulatory developments and stressed resilience through proactive scenario planning and flexible business operations.

Leadership Quotes:

“We are closely monitoring regulatory developments and building flexibility into our planning to adapt quickly as policies evolve.”

Gail Boudreaux, CEO, Q2 2025 Earnings Call Transcript

“Elevance mentioned that it is keeping an eye on potential changes stemming from the Trump administration’s initiatives to impose work requirements on Medicaid recipients.”

Elevance spokesperson to Reuters

“We remain committed to transparency and strong execution as we continue to navigate unprecedented cost trend affecting multiple lines of business.”

Gail Boudreaux, CEO, via FierceHealthcare

Targeted Growth with Retention

Amid membership declines in Medicaid and ACA, Elevance Health’s leadership reinforced their data-driven, targeted approach to growth and member retention.

Leadership Quotes:

“We expect minimal membership growth over the balance of the year as we maintain our marketing adjustments taken during AEP to optimize our member mix and improve retention. And so, taken together, the expected footprint change and lower in-year growth provide confidence in our full year guide...”

Mark Kaye, CFO, Barclays Healthcare Conference

Top-Line Performance

Elevance Health reported Q2 2025 operating revenue of $49.4 billion, up 14% from Q2 2024. Growth was fueled by higher premium yields in the Health Benefits segment, gains in Medicare Advantage membership, and recent acquisitions. These gains were partially offset by Medicaid membership attrition. The company continues to show strong top-line momentum, reflecting disciplined growth and diversified sources of premium revenue despite challenges in specific public-sector segments.

Elevance Health reported Q2 2025 operating revenue of $49.4 billion, up 14% from Q2 2024. Growth was fueled by higher premium yields in the Health Benefits segment, gains in Medicare Advantage membership, and recent acquisitions. These gains were partially offset by Medicaid membership attrition. The company continues to show strong top-line momentum, reflecting disciplined growth and diversified sources of premium revenue despite challenges in specific public-sector segments.

Q2 2025 Results

| Elevance Health | Q2 2025 | Q2 2024 | Change (%/bps) |

|---|---|---|---|

| Operating Revenue | $49.4B | $43.2B | 14.3% |

| Medical Loss Ratio | 88.9% | 86.3% | 260 bps |

| Adjusted Operating Expense Ratio | 10.0% | 11.4% | (140) bps |

| Adjusted Operating Gain | $2.5B | $2.9B | (14.2%) |

| Adjusted Operating Margin | 5.0% | 6.7% | (170) bps |

| Net Investment Income | $486M | $508M | (4.3%) |

| Adjusted Diluted EPS | $8.44 | $10.30 | (14.2%) |

| Operating Cash Flow | $2.1B | $0.4B | $1.6B |

Earnings and Margins

GAAP EPS: $7.72

- Earnings performance reflects pressure in Medicaid and ACA, despite solid performance in Medicare Advantage and commercial lines.

- FY 2025 Adjusted EPS guidance revised to ~$30.00, reflecting medical cost headwinds in ACA and Medicaid.

- Operating margin contracted to 4.9%, with adjusted margin at 5.0%, down 170 basis points year-over-year.

Cost & Medical Trends

While medical cost pressure remains a concern, administrative expense control supported operating margin stability and aligned with the company’s broader cost-efficiency and value-based care strategy. The benefit expense ratio rose to 88.9%, up 260 basis points from the prior year, primarily due to elevated medical cost trends in Medicaid and ACA health plans. Operating expense ratio improved to 10.1%, with an adjusted ratio at 10.0%, reflecting disciplined cost management and revenue leverage.

CMS Rebate Reallocation: What It Means for Medicare Advantage Plans

From Subsidy Shift to Strategic Reallocation

The recent CMS adjustment to Part D direct subsidies while presented as a technical update has become a strategic trigger for plan executives. Internally referred to by many clients as rebate reallocation, this refers to late-cycle shifts in rebate values (e.g., a $10–$20 delta from projected benchmarks) that can significantly impact final plan bids.

Plans must now respond with agility tweaking premiums, adjusting givebacks, and fine-tuning benefit configurations, all under high time pressure.

Rapid Response Requires Predictive Readiness

The organizations best prepared are those who’ve already run scenario simulations and can act on final rebate figures within hours, not days.

Where HealthworksAI’s xAI-Powered Intelligence Delivers

This is where our Benefit Simulator, powered by HealthworksAI’s xAI predictive analytics engine, creates true competitive advantage. With our platform, leading payers are able to:

- Pre-load likely subsidy ranges and simulate benefit trade-offs in advance.

- Quantify the enrollment and financial impact of each $ rebate shift.

- Align decisions with Stars, market share, and benchmark positioning across counties.

Make It Annual. Make It Actionable.

As CMS continues to evolve its IRA-driven reimbursement strategy, plans must treat this as a recurring AEP ritual. HealthworksAI clients are operationalizing this now embedding it into their annual benefit design calendar. Those who simulate earlier, win earlier.

DON’T FALL BEHIND

Your competitors already see what’s next.

These reports will plug directly into our Benefit Strategy Simulator™ to test competitive

scenarios by market, Stars, or subsidy impact.

REAL-TIME INTELLIGENCE. STRATEGIC ADVANTAGE

It’s earnings season — and while others wait for industry roundups, our clients already have the insights.

Key executive quotes flagged by theme (Stars, ACA, Medicaid, MLR, Compliance)

Market movements decoded by enrollment, benefit shifts & margin levers

Used by top MA teams to inform 2026 bid strategy & pricing

Deep-dive earnings call analysis within 24–48 hours