From Bid Season to AEP and Beyond: How HealthWorksAI's AI Powers Year-Round Wins in Medicare Advantage

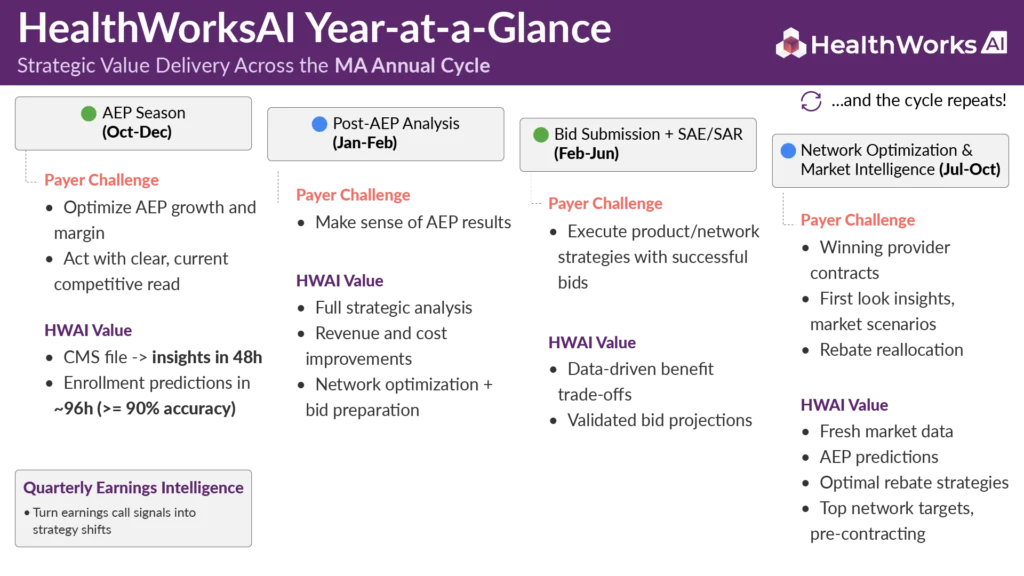

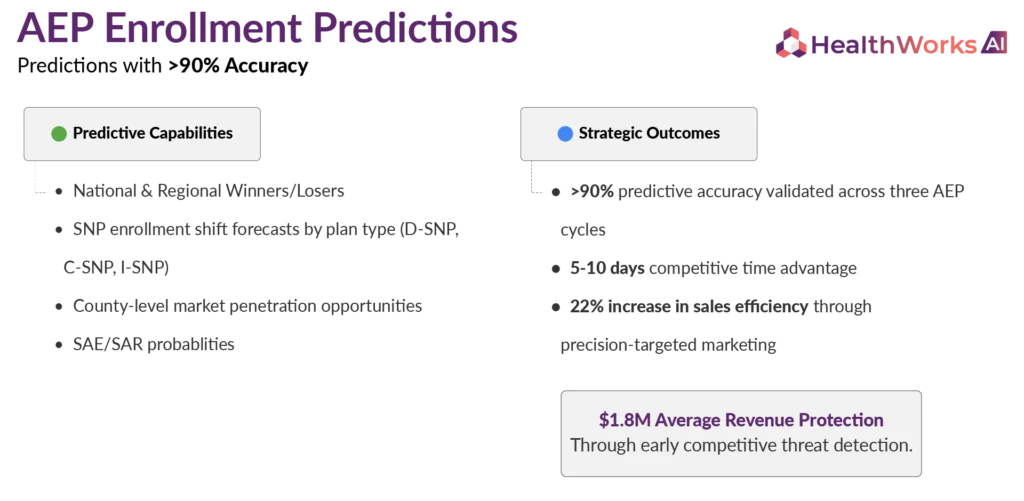

AI isn’t a buzzword in Medicare Advantage anymore, t’s a margin engine. The fastest-growing plans are using predictive analytics to drive growth and profitability, not just insights. At HealthWorksAI, we support clients year-round: during AEP we forecast enrollment with ~96% accuracy; in bid season we quantify cost/benefit trade-offs across product portfolios; and from June to October we enable real-time adjustments based on competitor plan and network moves.

HealthWorksAI’s comprehensive AI platform transforms the traditional reactive approach into a proactive, intelligence-driven strategy that anticipates market shifts, optimizes resource allocation, and executes with precision timing.

In the Advantage industry’s relentless calendar, from Feb-June bid submissions to October AEP battles to year-end performance analysis, demands quick decision-making backed by deep market intelligence. Yet a lot of health plans remain trapped in a cycle of reactive analysis, manual processes, and fragmented insights that arrive too late to drive competitive advantage.

The stakes have never been higher. With MA growth slowing to 3.9% in 2025, major payers cutting the growth forecasts and CMS’ regulatory headwinds intensifying, profitability increasingly belongs to plans that can anticipate, adapt, and act faster than their competitors.

The Medicare Advantage Intelligence Gap:

Today's Reality

- Backward-looking analysis leaves plans perpetually chasing market shifts instead of anticipating and shaping them.

- Information asymmetry means critical insights reach leadership too late to influence pivotal strategic moves.

- Manual data reconciliation of CMS releases and competitive filings burns precious weeks when hours matter most.

- Cross-functional silos between actuarial, product, network, and sales teams create decision blind spots and strategic misalignment.

The Cost of Delay

When Humana announced strategic exits affecting 560,000 members, or when UnitedHealth disclosed $600M in ACA marketplace losses, these weren’t sudden surprises, they were the culmination of months of unrecognized market signals that AI could have detected and quantified in real-time.

HealthWorksAI's Year-Round AI Advantage

1. Bid Season Intelligence (Feb–June): Precision Benefit Design

The Challenge: Traditional benefit design relies on static historical data and intuition, leading to costly misjudgments. Plans routinely over-invest in benefits that don’t drive enrollment or under-invest in features that could capture significant market share.

The Stakes: Cost of Misjudgment

- Sales impact: Sales people don’t get bonuses.

- Investor confidence: Investors lose confidence and stock prices fall.

- Operational fallout: Poor alignment between staffing levels can create poor member experience and cause a spike in disenrollments.

HealthWorksAI's AI-Powered Solution:

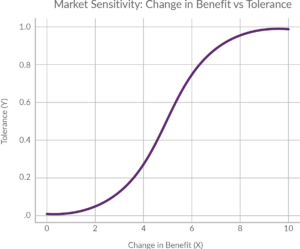

Advanced Benefit Simulator: Processes millions of market scenarios using proprietary algorithms that blend historical performance data, demographic trends, competitive positioning, and regulatory changes to forecast enrollment impact with unprecedented precision.

Advanced Benefit Simulator: Processes millions of market scenarios using proprietary algorithms that blend historical performance data, demographic trends, competitive positioning, and regulatory changes to forecast enrollment impact with unprecedented precision.

Total Plan Value (TPV) : Synthesizes product features, provider network strength, brand equity, and marketing effectiveness into a single predictive score that quantifies member-perceived value across market segments.

Quantifiable Impact:

- 35% improvement in benefit ROI through AI-identified high-impact adjustments

- 96% accuracy in plan predictions

- million (3,700 new members) in projected enrollment growth for a national plan.

Stop guessing benefit design. Quantify enrollment lift vs. rebate cost by county, before filing. Prioritize proven levers and document trade-offs.

Run scenarios on your toughest market to know winning bids

2. AEP Predictive Intelligence (October): The AI Battle Map

The Challenge: AEP data releases trigger a compressed 48-72 hour window where plans must rapidly decode competitive movements, identify market vulnerabilities, and execute tactical responses. Manual analysis simply cannot match the speed required for competitive advantage.

Our proprietary xAI platform combines multiple intelligence layers:

- Benefit Sensitivity Analysis modeling member responsiveness to plan changes.

- SAE/SAR Projection Models forecasting service area expansion patterns.

- Competitive Behavior Algorithms predicting rival strategic moves based on historical patterns.

From CMS data drop to clarity in 96 hours. Ranked counties by expected lift/drag.

3. Genie AI: Conversational Market Intelligence (Year-Round)

The Challenge: Senior executives need instant, nuanced answers to complex strategic questions without waiting for analyst reports or team huddles. Critical decisions stall while teams gather and synthesize information. And generic LLMs (e.g., ChatGPT) are trained on broad, public sources, useful for summaries, but not for Medicare/CMS focused data. Leaders need plan, network, and benefit-level MA data (the kind HealthWorksAI curates) to answer questions accurately and fast.

Dataset Included: PBP, Census, EOC, ANOC, SoB, Provider Network Data

HealthWorksAI's Conversational AI Assistant “Genie AI”:

Genie AI represents a breakthrough in healthcare analytics, a conversational interface trained on HWAI comprehensive Medicare Advantage market data, competitive intelligence, and regulatory insights. Leadership teams simply ask natural language questions and receive immediate, context-rich responses with supporting data visualization.

Sample Executive Conversations:

- “Which counties show the highest D-SNP growth potential for 2026?”

- “What specific benefits drove Humana’s 12% Florida market share gain last AEP?”

- “Where are Anthem’s network adequacy vulnerabilities creating opportunity?”

- “How will the new CMS risk adjustment changes affect our East Coast footprint?”

Decision-Making Transformation:

- Strategic discussions accelerated from days to minutes.

- Cross-functional alignment achieved through shared, real-time insights. Market opportunity identification happening at conversational speed.

- Competitive intelligence accessible to any authorized team member, anytime.

Why AI-Powered Plans Win

In an industry where UnitedHealth and Humana control majority of MA member-base and consolidation is accelerating, competitive advantage now hinges on intelligence and execution speed. HealthWorksAI’s platform creates compounding benefits:

Speed to decision & action

Get insights of CMS data within 48 hours from the release.

Lower costs

Cut analysis overhead, avoid misallocated benefits, and improve MLR via targeted product/network changes.

Prioritize the highest-ROI moves

Direct budget and effort to the benefits, channels, and partnerships that actually drive enrollment and margin.

Predictive vs. reactive

Anticipate competitor and member response instead of post-morteming last week’s results.

Unified intelligence

Break silos across Actuarial, Product, Sales, and Network with a shared, explainable AI view.

Scale without complexity

Offload data wrangling and pattern detection so teams focus on strategy.

Continuous learning

Every cycle sharpens accuracy, widening the gap over manual, lagging workflows.

Stop hunting across decks. Ask a strategic question and get a cited, plan/network-level answer instantly.

The Business Challenge

The leadership team needed a way to:

- Quickly evaluate where their networks were either insufficient or excessively developed relative to leading competitors.

- Determine which providers were crucial for adequacy, member preferences, and strategic alignment.

- Facilitate informed contracting choices with data-supported assurance—without dedicating months to analysis.

Their current internal tools and resources couldn’t accommodate the complexity or scale of this initiative.

The NetworkIntel™ Solution

1-to-Many Network Benchmarking Designed for Decision-Making

Using NetworkIntel™’s benchmarking capabilities, the team executed a 1-to-many network comparison analysis against leading competitors across more than 40 markets. This enabled them to:

- Quickly identify NPIs present in all top-performing networks, indicating critical or compliance-essential providers.

- Detect network deficiencies, redundancies, and anomalies by plan category, county/state, and Star rating level.

- Assess network scope and strategic depth instantaneously—without developing their own internal comparison framework.

Beyond The Scope of Output

Executive-Level Insight:

Summary KPIs, the exclusive Network Score, and easily digestible dashboards assisted leaders in prioritizing:

- Markets with quick growth potential.

- Networks needing immediate focus by product category

- Choices between expansion and rationalization.

Granular-Level Data:

NPI-level provider lists equipped contracting teams to undertake specific actions:

- End or renegotiate agreements with redundant or underperforming providers.

- Concentrate on impactful additions to match leading competitor networks.

Start optimizing your provider networks with NetworkIntel™

Are you interested in finding out what actions you can take to optimize your provider networks using NetworkIntel™'s Provider Network Analytics?